New Charges for Electric Vehicles Spark Debate Over Fairness and Environmental Impact

Published 6 November 2025

Highlights

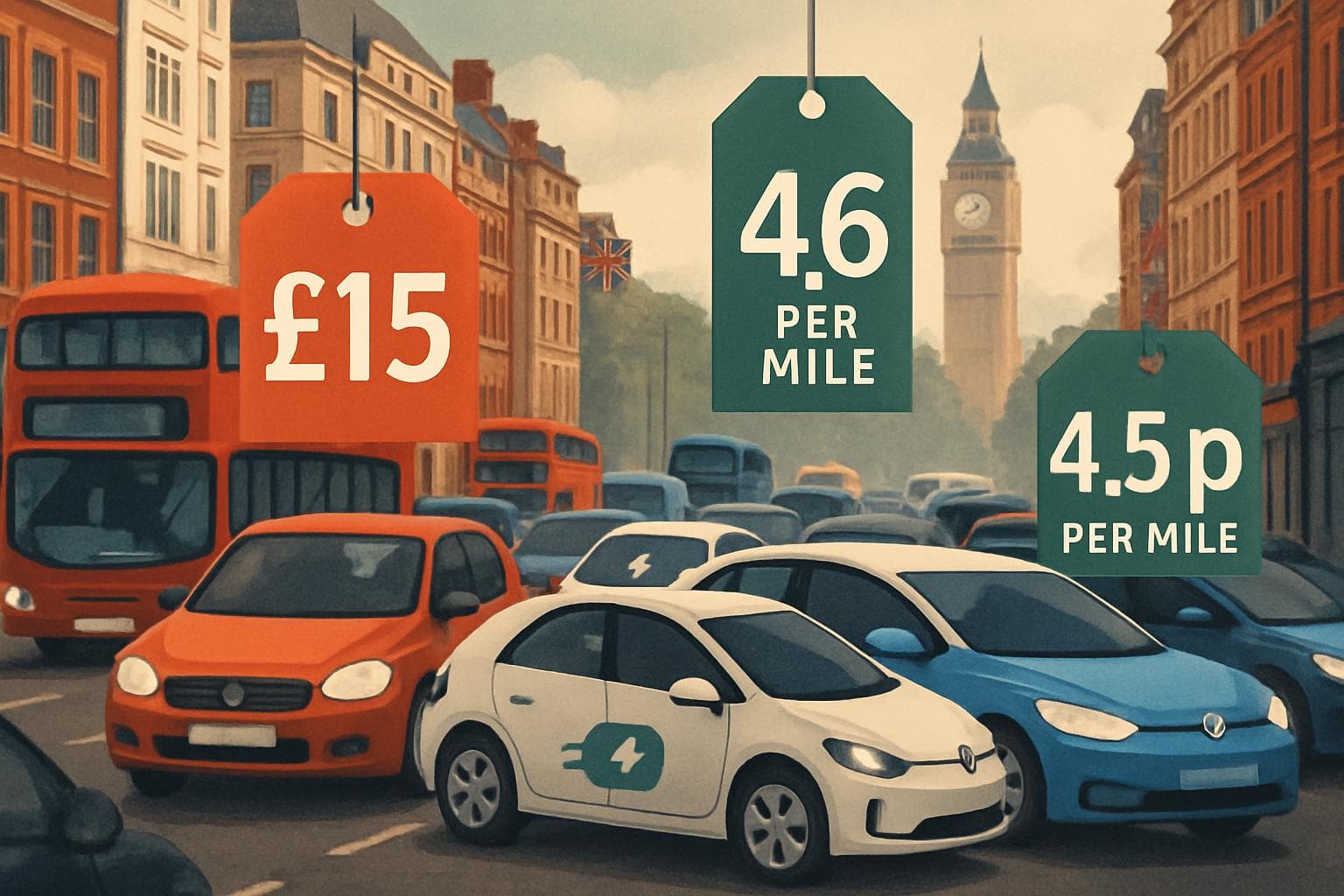

- Electric vehicles (EVs) will lose their exemption from London's congestion charge starting next year, potentially increasing minicab fares.

- A proposed pay-per-mile tax for EVs could be introduced in the UK by 2028 to offset declining fuel duty revenues.

- The congestion charge in London will rise from £15 to £18 per day from January 2, 2024, with EVs facing a new charge of £13.50 if registered for Auto Pay.

- Critics argue that these measures could deter the adoption of EVs and increase costs for consumers, impacting the transition to greener vehicles.

- The UK government aims to create a fairer tax system for all drivers while supporting the shift to electric vehicles.

-

Rewritten Article

Headline: New Charges for Electric Vehicles Spark Debate Over Fairness and Environmental Impact

As the UK government seeks to balance environmental goals with fiscal needs, electric vehicle (EV) owners are facing new financial challenges. Starting next year, electric vehicles will no longer be exempt from London's congestion charge, a move that could lead to increased minicab fares and deter drivers from switching to cleaner vehicles. The congestion charge is set to rise from £15 to £18 per day from January 2, 2024, with EVs required to pay £13.50 if registered for Auto Pay.

Congestion Charge Changes in London

Transport for London (TfL) announced that the exemption for electric cars and vans under the Cleaner Vehicle Discount will be scrapped by 2026. This decision aims to address rising congestion due to the increasing number of EVs on the road. However, critics, including minicab drivers like Kola Olalekan, warn that the new charges could lead to higher fares on ride-hailing platforms such as Uber and Bolt. "There's going to be a surge," Olalekan stated, expressing concerns over reduced driver availability and increased costs for riders.

Proposed Pay-Per-Mile Tax

In a related development, the UK government is considering a pay-per-mile tax for EVs, potentially starting in 2028. This proposal, reported by the Daily Telegraph, suggests a charge of 3p per mile to compensate for the loss of fuel duty revenue as more drivers transition to electric vehicles. The Society of Motor Manufacturers and Traders (SMMT) criticized the timing of this measure, arguing that it could hinder the EV transition. "A smarter, fair and future-ready taxation system requires a fundamental rethink," the SMMT stated.

Balancing Fiscal Needs and Environmental Goals

The government maintains that a fairer tax system is necessary to fund roads and public services while supporting the shift to electric vehicles. A spokesperson emphasized the importance of backing the transition away from petrol and diesel, highlighting £4 billion in support already provided. However, Shadow Chancellor Mel Stride opposed the new tax plans, calling them a "tax raid" on commuters and car owners.

-

Scenario Analysis

The introduction of new charges for electric vehicles could have significant implications for the UK's environmental and fiscal policies. If implemented, the congestion charge and pay-per-mile tax may slow the adoption of EVs, potentially impacting the country's climate goals. Experts suggest that a comprehensive review of the taxation system is needed to ensure it aligns with the UK's long-term environmental objectives. As the government navigates these challenges, it will be crucial to balance fiscal responsibilities with incentives that encourage the transition to cleaner transportation options.

As the UK government seeks to balance environmental goals with fiscal needs, electric vehicle (EV) owners are facing new financial challenges. Starting next year, electric vehicles will no longer be exempt from London's congestion charge, a move that could lead to increased minicab fares and deter drivers from switching to cleaner vehicles. The congestion charge is set to rise from £15 to £18 per day from January 2, 2024, with EVs required to pay £13.50 if registered for Auto Pay.

Congestion Charge Changes in London

Transport for London (TfL) announced that the exemption for electric cars and vans under the Cleaner Vehicle Discount will be scrapped by 2026. This decision aims to address rising congestion due to the increasing number of EVs on the road. However, critics, including minicab drivers like Kola Olalekan, warn that the new charges could lead to higher fares on ride-hailing platforms such as Uber and Bolt. "There's going to be a surge," Olalekan stated, expressing concerns over reduced driver availability and increased costs for riders.

Proposed Pay-Per-Mile Tax

In a related development, the UK government is considering a pay-per-mile tax for EVs, potentially starting in 2028. This proposal, reported by the Daily Telegraph, suggests a charge of 3p per mile to compensate for the loss of fuel duty revenue as more drivers transition to electric vehicles. The Society of Motor Manufacturers and Traders (SMMT) criticized the timing of this measure, arguing that it could hinder the EV transition. "A smarter, fair and future-ready taxation system requires a fundamental rethink," the SMMT stated.

Balancing Fiscal Needs and Environmental Goals

The government maintains that a fairer tax system is necessary to fund roads and public services while supporting the shift to electric vehicles. A spokesperson emphasized the importance of backing the transition away from petrol and diesel, highlighting £4 billion in support already provided. However, Shadow Chancellor Mel Stride opposed the new tax plans, calling them a "tax raid" on commuters and car owners.

What this might mean

The introduction of new charges for electric vehicles could have significant implications for the UK's environmental and fiscal policies. If implemented, the congestion charge and pay-per-mile tax may slow the adoption of EVs, potentially impacting the country's climate goals. Experts suggest that a comprehensive review of the taxation system is needed to ensure it aligns with the UK's long-term environmental objectives. As the government navigates these challenges, it will be crucial to balance fiscal responsibilities with incentives that encourage the transition to cleaner transportation options.