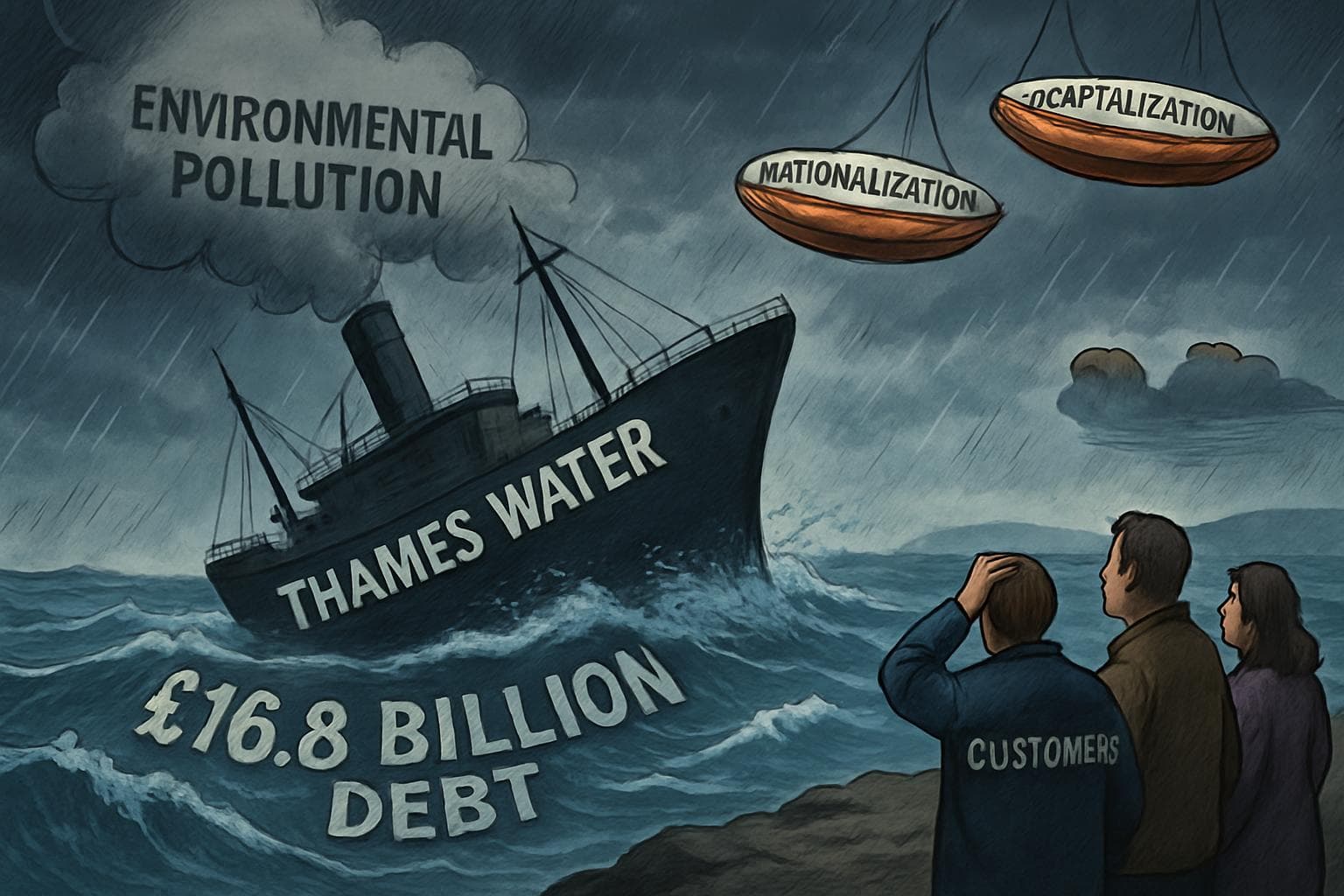

Thames Water Faces Decade-Long Recovery Amid Financial and Environmental Challenges

Published 15 July 2025

Highlights

- Thames Water reported a significant annual loss of £1.65 billion, with its debt rising to £16.8 billion.

- The company faces potential nationalisation if it cannot secure a rescue plan to stabilize its finances.

- Pollution incidents increased by more than a third, with serious incidents more than doubling from 14 to 34.

- Thames Water was fined £122.7 million by Ofwat for breaches related to sewage spills and shareholder payouts.

- CEO Chris Weston stated that turning the company around could take at least a decade, amid ongoing financial challenges.

Thames Water, the UK's largest water and waste company, is grappling with severe financial and operational challenges, as it reported a staggering £1.65 billion loss for the year ending March. The company's debt has ballooned to £16.8 billion, raising concerns about its future viability and the possibility of nationalisation.

Financial Struggles and Potential Nationalisation

The financial turmoil at Thames Water has been exacerbated by the withdrawal of a £4 billion rescue deal from US private equity firm KKR. This setback has heightened fears of the company collapsing into a government-supervised administration. Chris Weston, Thames Water's CEO, acknowledged the dire situation, stating, "The company is extremely stressed and operating in very difficult circumstances." He further emphasized that a turnaround could take between five to ten years, if not longer.

In an effort to stabilize its finances, Thames Water is working with senior creditors on a recapitalisation plan. The company has managed to draw down £350 million in March and £365 million in April, with an additional £157 million expected by the end of July. However, the company has issued a "going concern" warning, indicating that it requires the support of multiple stakeholders to avoid special administration.

Environmental and Operational Challenges

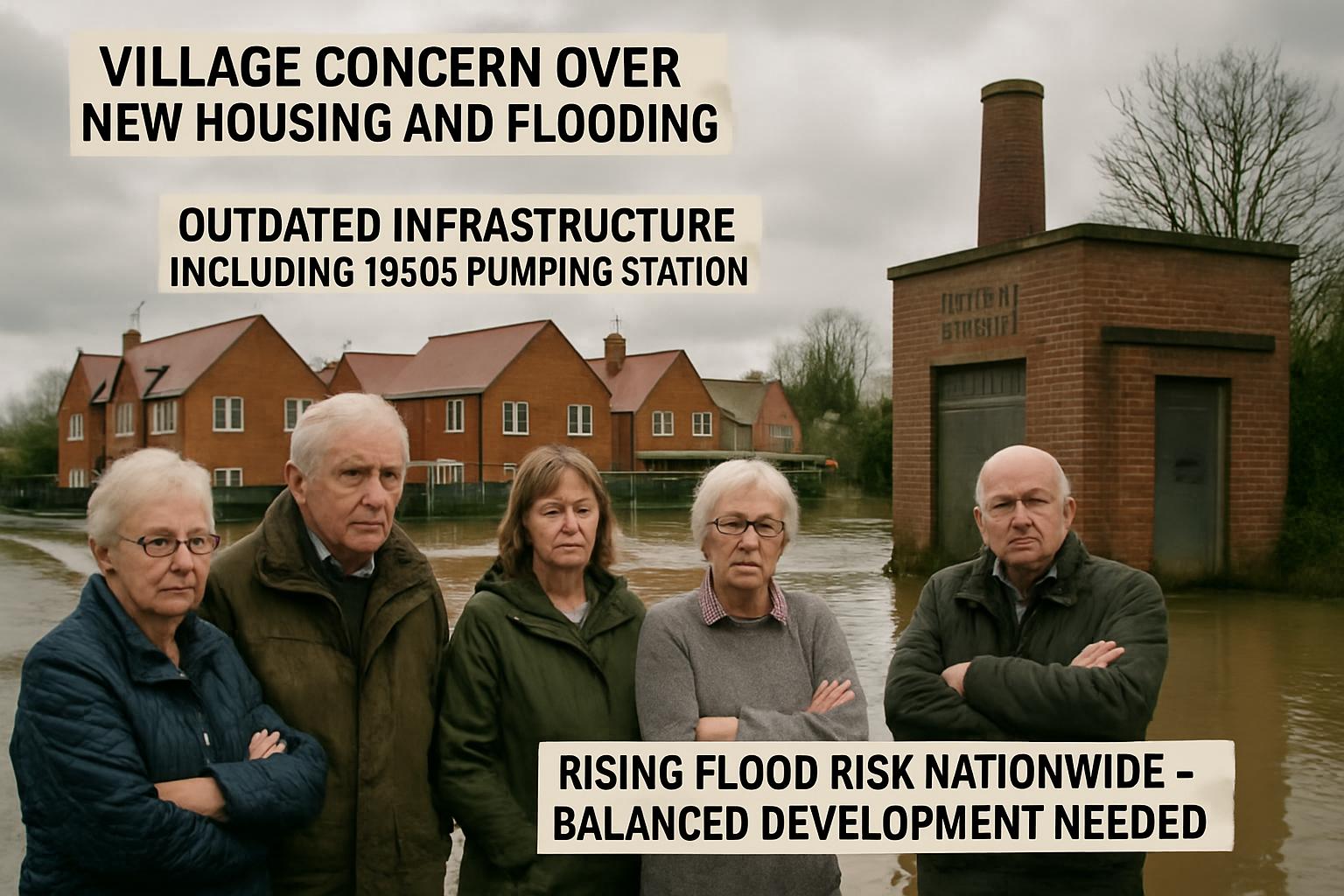

Thames Water's operational performance has also come under scrutiny, with pollution incidents rising by more than a third to 470, and serious incidents increasing from 14 to 34. The company attributed these issues to significant rainfall and high groundwater levels, which have overwhelmed its aging infrastructure. Despite these challenges, Weston claimed progress in addressing underlying causes, such as proactive sewer cleaning.

The company was fined £122.7 million by the water industry regulator Ofwat for breaches related to sewage spills and shareholder payouts. This fine, along with a £1.27 billion provision against a non-recoverable loan, contributed significantly to the annual loss. Thames Water has paused bonuses for some senior executives as part of its restructuring efforts.

Impact on Customers and Future Prospects

Thames Water serves approximately 16 million customers across London and southern England. Despite the financial woes, the company has assured that the Ofwat fines will be borne by the company and its investors, not by customers. However, water bills have increased, with Thames customers now paying between £488 and £639 annually.

What this might mean

The future of Thames Water remains uncertain as it navigates its financial crisis. If the recapitalisation plan fails, the company may face nationalisation, a move that could reshape the UK's water industry landscape. Experts suggest that a successful turnaround will require significant investment in infrastructure and a re-evaluation of regulatory frameworks. As Thames Water works to regain stability, its ability to address environmental challenges and improve operational performance will be crucial in restoring public trust and ensuring sustainable water supply for millions of customers.