UK Government Faces Backlash Over Business Rates Relief for Pubs and Music Venues

Published 27 January 2026

Highlights

- Nearly 50 Labour MPs have urged Chancellor Rachel Reeves to halt the upcoming business rate increase for music venues, citing existential threats to their survival.

- The UK government announced a £80m annual support package for pubs and live music venues, offering a 15% discount on business rates from April.

- Critics argue the relief package is insufficient and excludes other sectors like hotels and restaurants, which face significant rate hikes.

- The hospitality industry warns of widespread closures and job losses without broader support, as costs continue to rise.

- The Treasury plans to review the valuation methods for pubs and hotels, but broader business rates reform remains a contentious issue.

-

Rewritten Article

Headline: UK Government Faces Backlash Over Business Rates Relief for Pubs and Music Venues

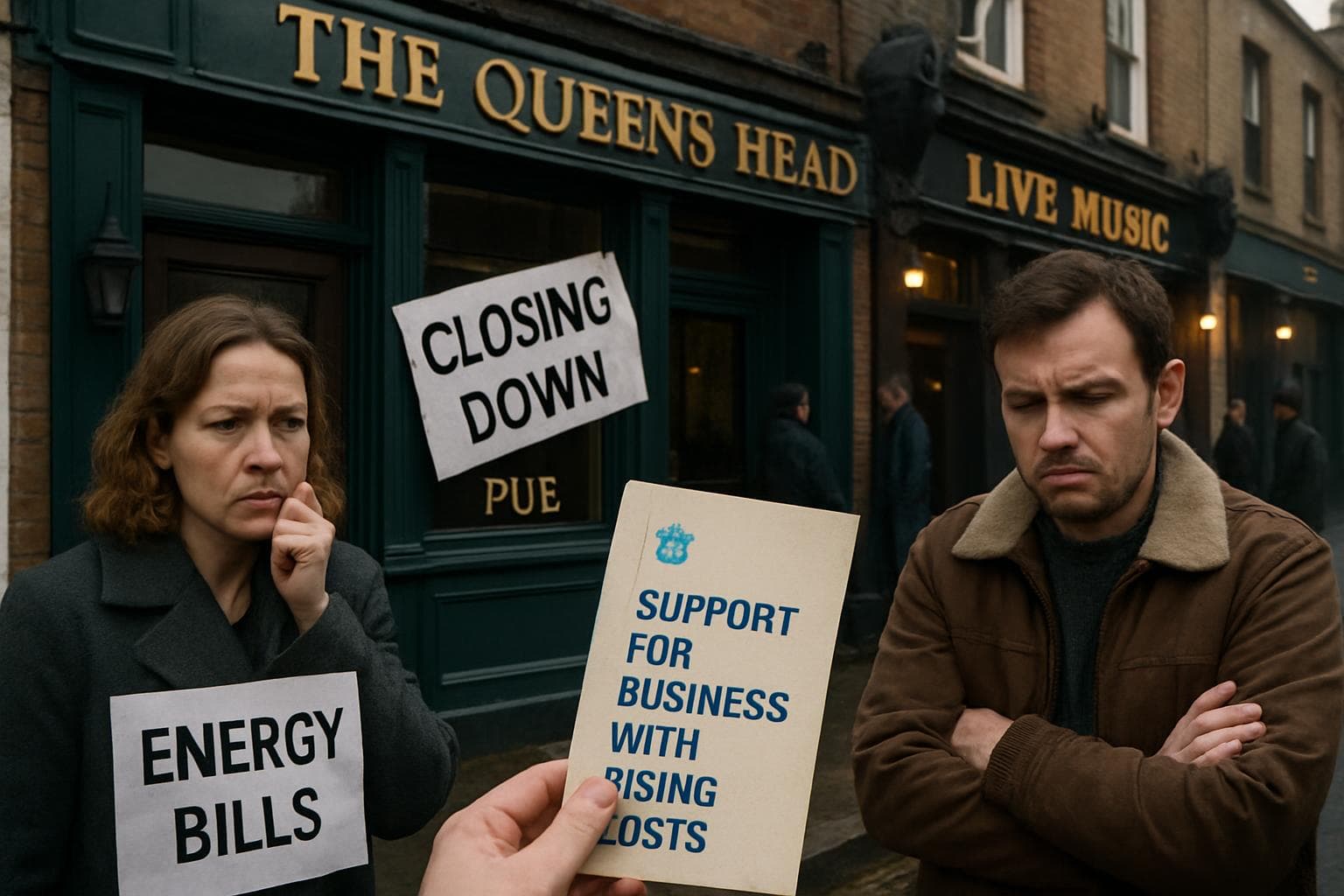

The UK government has announced a £80 million annual support package aimed at easing the financial burden on pubs and live music venues, following intense pressure from the hospitality sector and Labour MPs. The relief, which includes a 15% discount on business rates starting in April, comes amid warnings of widespread closures and job losses due to rising costs.

Government's Response to Rising Costs

Chancellor Rachel Reeves, under pressure from nearly 50 Labour MPs, has been urged to reconsider the impending business rate hikes for music venues. The MPs, led by Knowsley MP Anneliese Midgley, argue that the revaluation could increase bills by up to 275%, posing an existential threat to these cultural hubs. In response, the Treasury has introduced a support package that will freeze rates in real terms for two years, benefiting pubs and live music venues.

Criticism and Calls for Broader Support

Despite the relief, critics, including Shadow Chancellor Mel Stride, have dismissed the measures as inadequate. Stride described the package as a "sticking plaster," warning that it merely delays inevitable financial pain. The hospitality industry, represented by UKHospitality, has called for the support to be extended to hotels, restaurants, and other businesses facing similar challenges. "The rising cost of doing business is a hospitality-wide problem," said UKHospitality Chair Kate Nicholls.

Sector-Specific Challenges and Future Reforms

The Treasury's decision to focus on pubs and music venues has sparked criticism from other sectors. Michael Kill, CEO of the Night Time Industries Association, highlighted the severe impact on nightclubs and bars, questioning the government's narrow focus. Meanwhile, the Treasury has promised to review the valuation methods for pubs and hotels, with a broader reform of the business rates system still under discussion.

-

Scenario Analysis

The government's relief package, while providing temporary respite for pubs and music venues, may not be enough to quell discontent across the broader hospitality sector. As costs continue to rise, the pressure for a comprehensive overhaul of the business rates system is likely to intensify. Experts suggest that without significant reform, the sector could face further closures and job losses. The Treasury's upcoming reviews of valuation methods may offer some hope, but the need for a more inclusive and sustainable solution remains critical. As the situation unfolds, the government will need to balance fiscal responsibility with the urgent needs of the hospitality industry to prevent further economic fallout.

The UK government has announced a £80 million annual support package aimed at easing the financial burden on pubs and live music venues, following intense pressure from the hospitality sector and Labour MPs. The relief, which includes a 15% discount on business rates starting in April, comes amid warnings of widespread closures and job losses due to rising costs.

Government's Response to Rising Costs

Chancellor Rachel Reeves, under pressure from nearly 50 Labour MPs, has been urged to reconsider the impending business rate hikes for music venues. The MPs, led by Knowsley MP Anneliese Midgley, argue that the revaluation could increase bills by up to 275%, posing an existential threat to these cultural hubs. In response, the Treasury has introduced a support package that will freeze rates in real terms for two years, benefiting pubs and live music venues.

Criticism and Calls for Broader Support

Despite the relief, critics, including Shadow Chancellor Mel Stride, have dismissed the measures as inadequate. Stride described the package as a "sticking plaster," warning that it merely delays inevitable financial pain. The hospitality industry, represented by UKHospitality, has called for the support to be extended to hotels, restaurants, and other businesses facing similar challenges. "The rising cost of doing business is a hospitality-wide problem," said UKHospitality Chair Kate Nicholls.

Sector-Specific Challenges and Future Reforms

The Treasury's decision to focus on pubs and music venues has sparked criticism from other sectors. Michael Kill, CEO of the Night Time Industries Association, highlighted the severe impact on nightclubs and bars, questioning the government's narrow focus. Meanwhile, the Treasury has promised to review the valuation methods for pubs and hotels, with a broader reform of the business rates system still under discussion.

What this might mean

The government's relief package, while providing temporary respite for pubs and music venues, may not be enough to quell discontent across the broader hospitality sector. As costs continue to rise, the pressure for a comprehensive overhaul of the business rates system is likely to intensify. Experts suggest that without significant reform, the sector could face further closures and job losses. The Treasury's upcoming reviews of valuation methods may offer some hope, but the need for a more inclusive and sustainable solution remains critical. As the situation unfolds, the government will need to balance fiscal responsibility with the urgent needs of the hospitality industry to prevent further economic fallout.