Unimetals Files for Liquidation, Threatening Over 650 Jobs in the UK

In This Article

HIGHLIGHTS

- Unimetals, a UK-based metals recycling company, has filed for compulsory liquidation, putting over 650 jobs at risk.

- The company, founded in 2023, struggled with financial difficulties after acquiring Sims Metal's UK business for £195 million.

- Despite efforts to secure new financing and potential buyers, no deal was concluded, leading to the winding-up petition.

- Alvarez & Marsal has been appointed to manage the liquidation process, aiming for a responsible and transparent approach.

- The metals recycling industry, crucial for transitioning away from fossil fuels, faces challenges due to fluctuating scrap metal prices.

Unimetals, a prominent player in the UK's metals recycling sector, has filed for compulsory liquidation, casting uncertainty over the future of more than 650 employees. The company, headquartered in Stratford-upon-Avon, operates 27 sites across the UK, including major locations in London, Greater Manchester, and Devon.

Financial Struggles and Failed Acquisition

Founded in 2023 by metals traders Jamie Afnaim and Alec Sellem, Unimetals aimed to capitalize on the growing demand for recycled metals, particularly those critical for the transition away from fossil fuels. In October 2024, the company acquired the UK operations of Australian firm Sims Metal for £195 million, which included four metal shredders and three port facilities. However, Unimetals faced financial hurdles as the supply of scrap metal exceeded demand, leading to price drops and financial strain.

Efforts to Secure Financing

In a bid to avert liquidation, Unimetals engaged in an accelerated mergers and acquisitions process, seeking potential buyers or investors. Despite substantial interest, no transaction materialized. "We have worked tirelessly to explore every possible option to secure new financing," a company spokesperson stated, acknowledging the distressing impact on employees.

Managing the Liquidation Process

Alvarez & Marsal, a consulting firm, has been appointed to oversee the liquidation process. The company emphasized its commitment to managing the situation responsibly and transparently, working closely with stakeholders, including employees, suppliers, and creditors. "Our priority now is to agree on a clear plan and timeline for what happens next," the spokesperson added.

Industry Challenges and Future Prospects

The metals recycling industry, vital for sustainable development and reducing reliance on fossil fuels, faces challenges due to fluctuating scrap metal prices. The switch to electric arc furnaces, which efficiently melt recycled steel, offers hope for the sector's long-term prospects. However, Unimetals' financial woes highlight the volatility and risks inherent in the industry.

WHAT THIS MIGHT MEAN

The liquidation of Unimetals could have significant repercussions for the UK's metals recycling industry, potentially leading to job losses and disruptions in the supply chain. As Alvarez & Marsal navigates the liquidation process, the focus will be on minimizing the impact on employees and creditors. The situation underscores the need for strategic planning and financial resilience in the face of market volatility.

Looking ahead, the metals recycling sector may need to adapt to changing market dynamics, including the integration of advanced technologies like electric arc furnaces. Policymakers and industry leaders might also explore measures to stabilize scrap metal prices and support companies in financial distress, ensuring the sector's continued contribution to sustainable development.

Related Articles

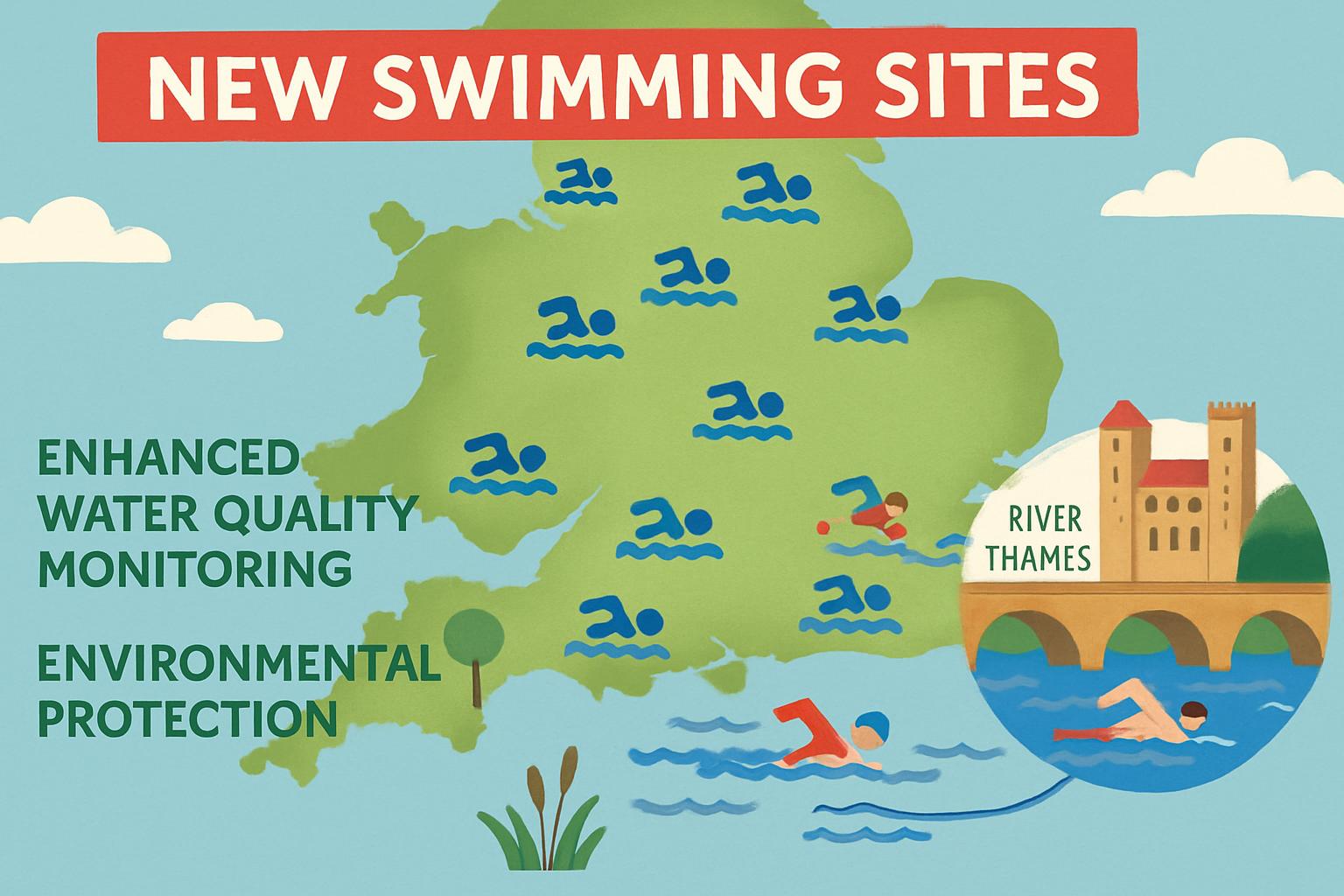

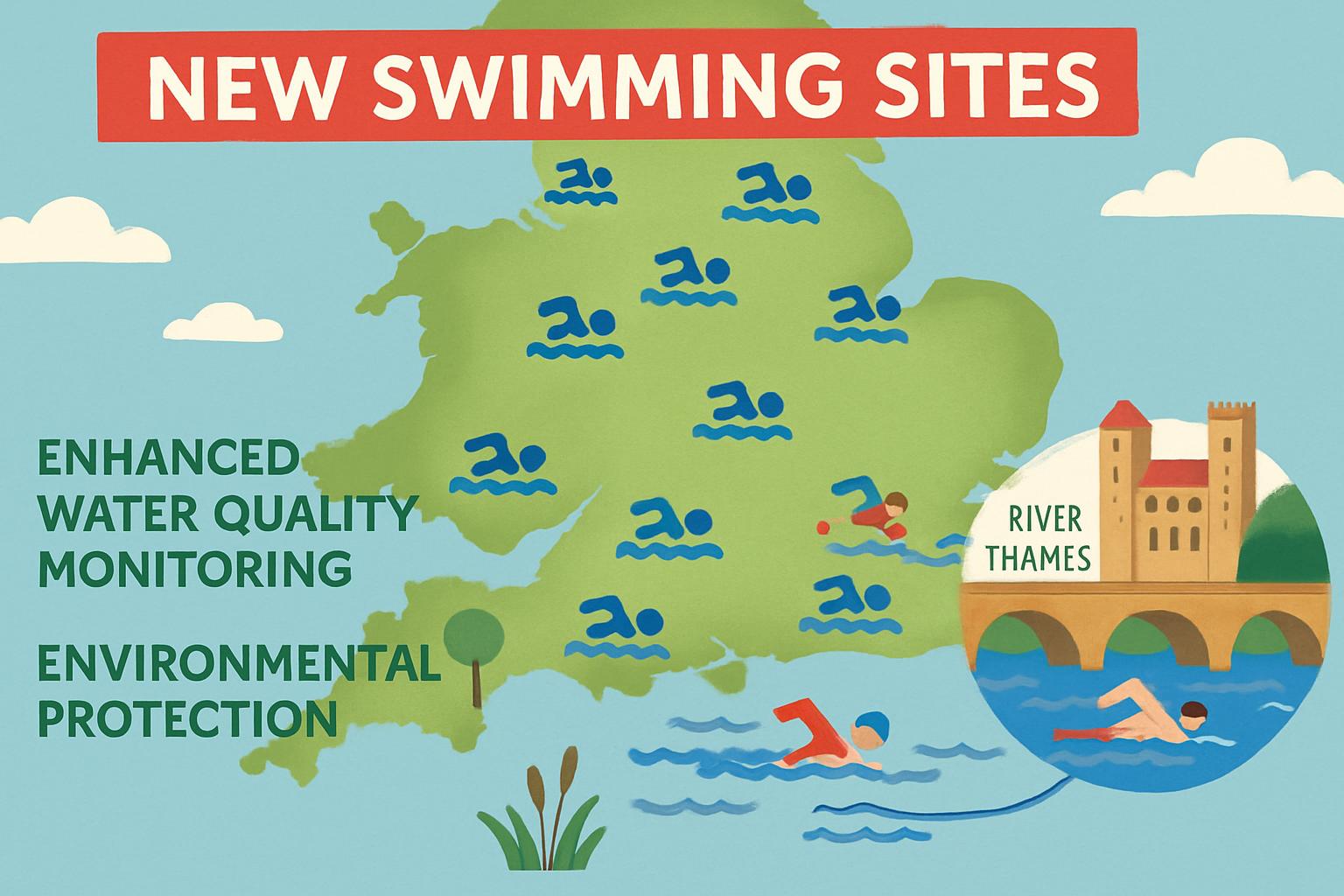

New Swimming Sites Proposed to Boost Water Quality Across England

Bafta Film Awards 2026: A Night of Glamour and Identity Challenges

Stockport Man Faces 48 Charges in Alleged Conspiracy to Rape Unconscious Wife

UK Police Intensify Investigation into Andrew Mountbatten-Windsor Amid Misconduct Allegations

Prince Andrew's Arrest Raises Questions About Royal Succession and Monarchy's Future

Global Counsel Faces Collapse Amidst Epstein Scandal Fallout

Unimetals Files for Liquidation, Threatening Over 650 Jobs in the UK

In This Article

Daniel Rivera| Published

Daniel Rivera| Published HIGHLIGHTS

- Unimetals, a UK-based metals recycling company, has filed for compulsory liquidation, putting over 650 jobs at risk.

- The company, founded in 2023, struggled with financial difficulties after acquiring Sims Metal's UK business for £195 million.

- Despite efforts to secure new financing and potential buyers, no deal was concluded, leading to the winding-up petition.

- Alvarez & Marsal has been appointed to manage the liquidation process, aiming for a responsible and transparent approach.

- The metals recycling industry, crucial for transitioning away from fossil fuels, faces challenges due to fluctuating scrap metal prices.

Unimetals, a prominent player in the UK's metals recycling sector, has filed for compulsory liquidation, casting uncertainty over the future of more than 650 employees. The company, headquartered in Stratford-upon-Avon, operates 27 sites across the UK, including major locations in London, Greater Manchester, and Devon.

Financial Struggles and Failed Acquisition

Founded in 2023 by metals traders Jamie Afnaim and Alec Sellem, Unimetals aimed to capitalize on the growing demand for recycled metals, particularly those critical for the transition away from fossil fuels. In October 2024, the company acquired the UK operations of Australian firm Sims Metal for £195 million, which included four metal shredders and three port facilities. However, Unimetals faced financial hurdles as the supply of scrap metal exceeded demand, leading to price drops and financial strain.

Efforts to Secure Financing

In a bid to avert liquidation, Unimetals engaged in an accelerated mergers and acquisitions process, seeking potential buyers or investors. Despite substantial interest, no transaction materialized. "We have worked tirelessly to explore every possible option to secure new financing," a company spokesperson stated, acknowledging the distressing impact on employees.

Managing the Liquidation Process

Alvarez & Marsal, a consulting firm, has been appointed to oversee the liquidation process. The company emphasized its commitment to managing the situation responsibly and transparently, working closely with stakeholders, including employees, suppliers, and creditors. "Our priority now is to agree on a clear plan and timeline for what happens next," the spokesperson added.

Industry Challenges and Future Prospects

The metals recycling industry, vital for sustainable development and reducing reliance on fossil fuels, faces challenges due to fluctuating scrap metal prices. The switch to electric arc furnaces, which efficiently melt recycled steel, offers hope for the sector's long-term prospects. However, Unimetals' financial woes highlight the volatility and risks inherent in the industry.

WHAT THIS MIGHT MEAN

The liquidation of Unimetals could have significant repercussions for the UK's metals recycling industry, potentially leading to job losses and disruptions in the supply chain. As Alvarez & Marsal navigates the liquidation process, the focus will be on minimizing the impact on employees and creditors. The situation underscores the need for strategic planning and financial resilience in the face of market volatility.

Looking ahead, the metals recycling sector may need to adapt to changing market dynamics, including the integration of advanced technologies like electric arc furnaces. Policymakers and industry leaders might also explore measures to stabilize scrap metal prices and support companies in financial distress, ensuring the sector's continued contribution to sustainable development.

Related Articles

New Swimming Sites Proposed to Boost Water Quality Across England

Bafta Film Awards 2026: A Night of Glamour and Identity Challenges

Stockport Man Faces 48 Charges in Alleged Conspiracy to Rape Unconscious Wife

UK Police Intensify Investigation into Andrew Mountbatten-Windsor Amid Misconduct Allegations

Prince Andrew's Arrest Raises Questions About Royal Succession and Monarchy's Future

Global Counsel Faces Collapse Amidst Epstein Scandal Fallout