Trump Media's Bold Move: $6 Billion Fusion Power Merger with TAE Technologies

In This Article

HIGHLIGHTS

- Trump Media & Technology Group plans a $6 billion merger with TAE Technologies, aiming to create a publicly traded fusion power company.

- The merger will result in a 50:50 ownership split, with completion expected by mid-2026, pending regulatory and shareholder approvals.

- TAE Technologies, backed by Google and Chevron, focuses on developing fusion power and energy storage technologies.

- Trump Media's CEO, Devin Nunes, emphasizes the merger's potential to revolutionize energy supply and support America's AI and manufacturing sectors.

- The deal reflects Trump Media's strategic shift from social media to the energy sector, amid rising electricity demand for AI data centers.

In a surprising strategic pivot, Trump Media & Technology Group (TMTG) has announced a $6 billion merger with TAE Technologies, a company at the forefront of fusion power development. The deal, unveiled on Thursday, aims to establish one of the world's first publicly traded fusion power companies, marking a significant shift for TMTG from its social media roots.

A Strategic Shift to Fusion Power

The merger, expected to be finalized by mid-2026, will see both companies holding equal ownership stakes. TAE Technologies, supported by major investors like Google and Chevron, specializes in nuclear fusion—a promising technology that seeks to replicate the sun's energy production process on Earth. This method could potentially provide vast amounts of clean energy with minimal radioactive waste.

Devin Nunes, CEO of Trump Media, highlighted the merger's potential to cement America's global energy dominance. "Fusion power will be the most dramatic energy breakthrough since the 1950s," Nunes stated, emphasizing its role in lowering energy costs and boosting supply to meet the growing demands of AI data centers.

Financial and Operational Details

As part of the agreement, Trump Media will inject up to $200 million into TAE Technologies upon deal completion, with an additional $100 million available post-registration. The combined entity plans to begin constructing a utility-scale fusion power plant next year, with further projects anticipated.

Despite its ambitions, Trump Media has faced financial challenges, reporting a $54.8 million loss in the third quarter. The merger is seen as a strategic move to leverage TAE's advanced technologies and capitalize on the rising demand for cleaner energy sources.

Leadership and Future Prospects

The new company will be co-led by Devin Nunes and TAE's CEO, Michl Binderbauer. The merger has already received board approval, and industry analysts suggest that TAE's technological prowess will likely drive the combined company's future direction.

WHAT THIS MIGHT MEAN

The merger between Trump Media and TAE Technologies could significantly impact the energy sector, particularly if fusion power becomes commercially viable. Experts suggest that successful implementation could lead to a new era of energy abundance, reducing reliance on fossil fuels and supporting the burgeoning AI industry. However, the path to commercial fusion power is fraught with technical and regulatory challenges, and the companies will need to navigate these hurdles to realize their ambitious goals. If successful, this merger could position the United States as a leader in next-generation energy technologies, with potential geopolitical and economic implications.

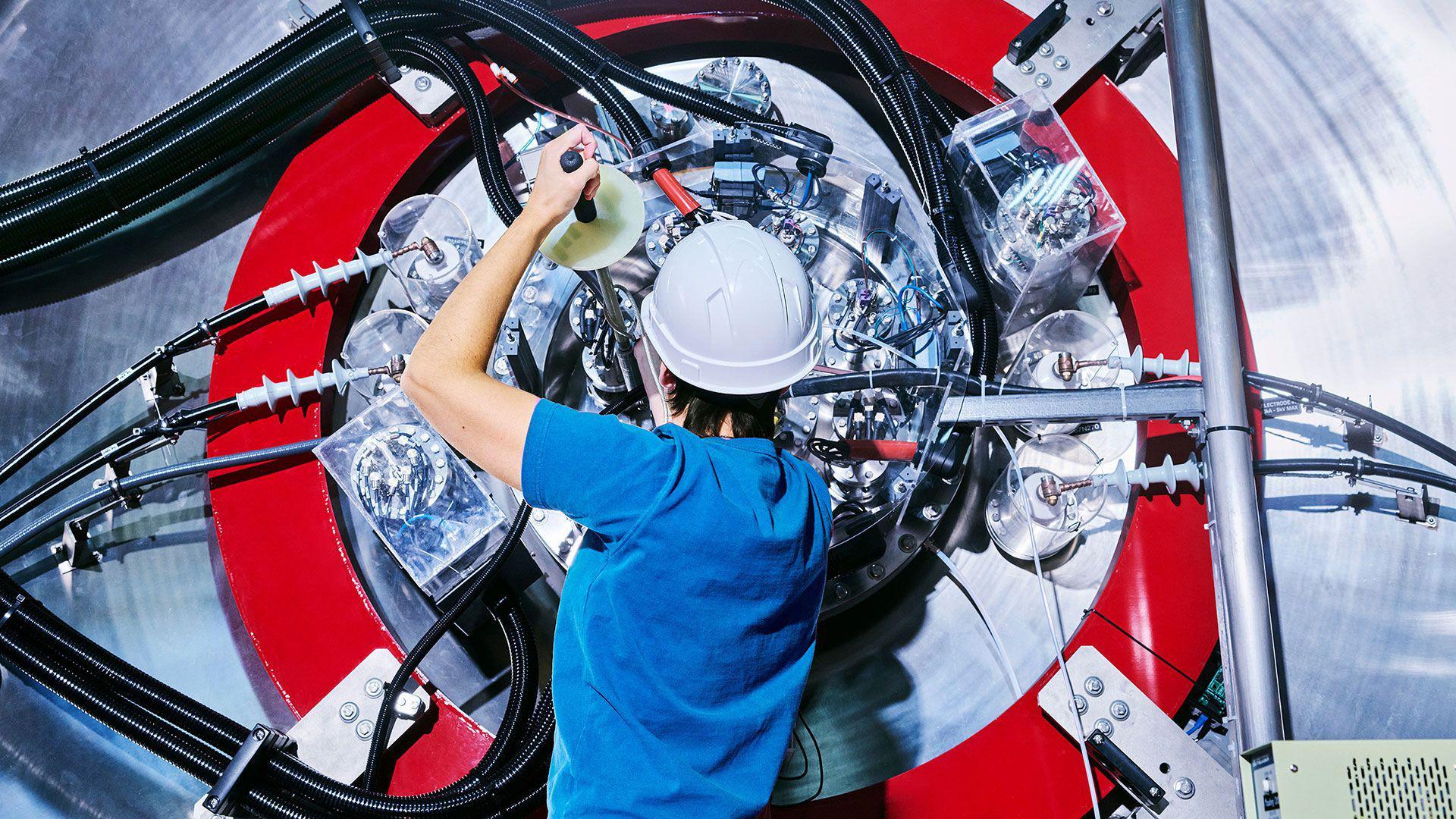

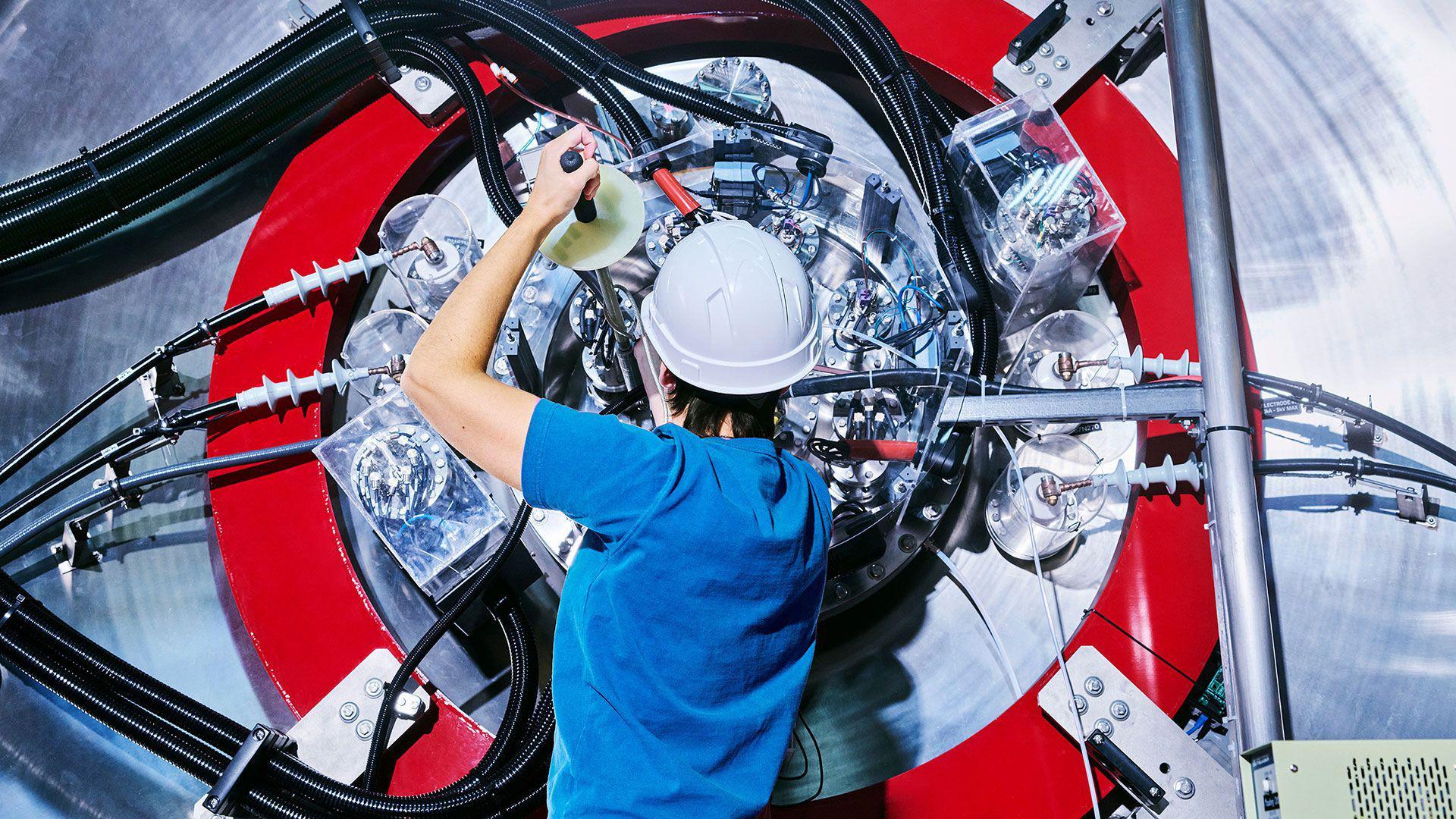

Images from the Web

Related Articles

Zuckerberg Defends Meta in Landmark Social Media Addiction Trial

Iranian Students Lead Major Protests Amid Rising US-Iran Tensions

Israeli Airstrikes in Lebanon's Bekaa Valley Leave 10 Dead Amid Rising Tensions

US Economic Growth Slows Amid Government Shutdown and Inflation Concerns

Rising Tensions: Trump's Dual Approach to Iran's Nuclear Challenge

UK Denies US Use of Military Bases for Potential Iran Strikes Amid Chagos Islands Dispute

Trump Media's Bold Move: $6 Billion Fusion Power Merger with TAE Technologies

In This Article

Himanshu Kaushik| Published

Himanshu Kaushik| Published HIGHLIGHTS

- Trump Media & Technology Group plans a $6 billion merger with TAE Technologies, aiming to create a publicly traded fusion power company.

- The merger will result in a 50:50 ownership split, with completion expected by mid-2026, pending regulatory and shareholder approvals.

- TAE Technologies, backed by Google and Chevron, focuses on developing fusion power and energy storage technologies.

- Trump Media's CEO, Devin Nunes, emphasizes the merger's potential to revolutionize energy supply and support America's AI and manufacturing sectors.

- The deal reflects Trump Media's strategic shift from social media to the energy sector, amid rising electricity demand for AI data centers.

In a surprising strategic pivot, Trump Media & Technology Group (TMTG) has announced a $6 billion merger with TAE Technologies, a company at the forefront of fusion power development. The deal, unveiled on Thursday, aims to establish one of the world's first publicly traded fusion power companies, marking a significant shift for TMTG from its social media roots.

A Strategic Shift to Fusion Power

The merger, expected to be finalized by mid-2026, will see both companies holding equal ownership stakes. TAE Technologies, supported by major investors like Google and Chevron, specializes in nuclear fusion—a promising technology that seeks to replicate the sun's energy production process on Earth. This method could potentially provide vast amounts of clean energy with minimal radioactive waste.

Devin Nunes, CEO of Trump Media, highlighted the merger's potential to cement America's global energy dominance. "Fusion power will be the most dramatic energy breakthrough since the 1950s," Nunes stated, emphasizing its role in lowering energy costs and boosting supply to meet the growing demands of AI data centers.

Financial and Operational Details

As part of the agreement, Trump Media will inject up to $200 million into TAE Technologies upon deal completion, with an additional $100 million available post-registration. The combined entity plans to begin constructing a utility-scale fusion power plant next year, with further projects anticipated.

Despite its ambitions, Trump Media has faced financial challenges, reporting a $54.8 million loss in the third quarter. The merger is seen as a strategic move to leverage TAE's advanced technologies and capitalize on the rising demand for cleaner energy sources.

Leadership and Future Prospects

The new company will be co-led by Devin Nunes and TAE's CEO, Michl Binderbauer. The merger has already received board approval, and industry analysts suggest that TAE's technological prowess will likely drive the combined company's future direction.

WHAT THIS MIGHT MEAN

The merger between Trump Media and TAE Technologies could significantly impact the energy sector, particularly if fusion power becomes commercially viable. Experts suggest that successful implementation could lead to a new era of energy abundance, reducing reliance on fossil fuels and supporting the burgeoning AI industry. However, the path to commercial fusion power is fraught with technical and regulatory challenges, and the companies will need to navigate these hurdles to realize their ambitious goals. If successful, this merger could position the United States as a leader in next-generation energy technologies, with potential geopolitical and economic implications.

Images from the Web

Related Articles

Zuckerberg Defends Meta in Landmark Social Media Addiction Trial

Iranian Students Lead Major Protests Amid Rising US-Iran Tensions

Israeli Airstrikes in Lebanon's Bekaa Valley Leave 10 Dead Amid Rising Tensions

US Economic Growth Slows Amid Government Shutdown and Inflation Concerns

Rising Tensions: Trump's Dual Approach to Iran's Nuclear Challenge

UK Denies US Use of Military Bases for Potential Iran Strikes Amid Chagos Islands Dispute