UK Faces Economic Challenges as Labour Considers Tax Policy Adjustments

Published 6 August 2025

Highlights

- Keir Starmer has not ruled out potential tax increases in the upcoming autumn budget, despite previous pledges to avoid raising income tax, National Insurance, or VAT.

- The National Institute of Economic and Social Research (NIESR) forecasts a potential £40-50bn deficit, suggesting moderate but sustained tax rises may be necessary.

- Labour's Deputy Prime Minister Angela Rayner's plans to reallocate local authority funding could lead to increased council tax in wealthier areas.

- The government faces pressure to balance the books without breaking its tax promises, amid economic uncertainty and rising public finance shortfalls.

- Starmer emphasizes improving living standards, focusing on raising wages and reducing costs like mortgages, despite economic challenges.

-

Rewritten Article

Headline: UK Faces Economic Challenges as Labour Considers Tax Policy Adjustments

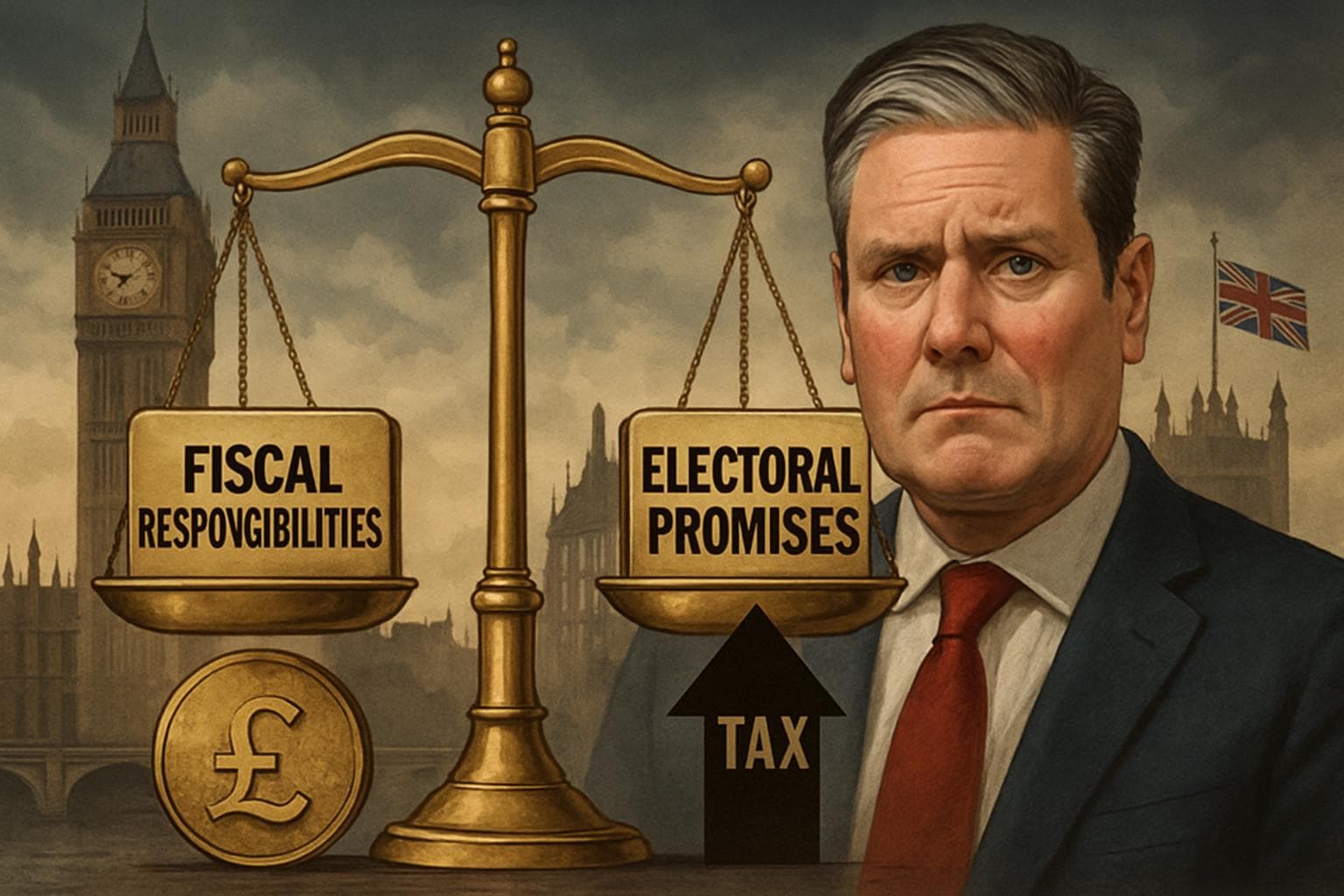

The UK government, led by Labour's Keir Starmer, is navigating a complex economic landscape as it approaches the autumn budget. Amidst forecasts of a significant public finance deficit, Starmer has not dismissed the possibility of tax increases, despite previous commitments to maintain current rates of income tax, National Insurance, and VAT.

Economic Forecasts and Fiscal Challenges

The National Institute of Economic and Social Research (NIESR) has projected a potential shortfall of £40-50bn in the UK's public finances. This forecast suggests that the government may need to implement moderate but sustained tax rises to address the deficit. The think tank's analysis highlights the challenges faced by Chancellor Rachel Reeves, who must balance fiscal rules with economic realities.

Potential Tax Adjustments and Local Funding

Labour's Deputy Prime Minister Angela Rayner has proposed reallocating local authority funding to support more deprived areas, a move that could result in increased council tax for wealthier regions. This proposal aligns with the broader economic strategy but adds pressure on local governments to maintain services amidst budget constraints.

Starmer's Economic Vision

During a visit to Milton Keynes, Starmer sought to reassure the public by emphasizing Labour's focus on improving living standards. "Our priority is to ensure people feel better off," he stated, highlighting efforts to raise wages and reduce costs like mortgages. Despite the economic uncertainty, Starmer remains committed to stabilizing the economy and enhancing the quality of life for UK citizens.

Political and Economic Implications

Labour's economic strategy faces scrutiny as it attempts to balance fiscal responsibility with electoral promises. The NIESR report has fueled speculation about potential tax policy changes, including adjustments to VAT and income tax thresholds. While Culture Secretary Lisa Nandy has ruled out a wealth tax, the government remains under pressure to clarify its approach to addressing the fiscal deficit.

-

Scenario Analysis

As the autumn budget approaches, the UK government must navigate a delicate balance between maintaining fiscal discipline and fulfilling electoral promises. The potential for tax increases looms large, with economic forecasts suggesting significant challenges ahead. Experts suggest that Labour may need to reconsider its tax pledges to address the fiscal shortfall effectively.

The political implications of breaking tax promises could be significant, potentially affecting Labour's standing with voters. However, the government's focus on improving living standards may help mitigate public concerns. As economic conditions evolve, the government's ability to adapt its strategy will be crucial in maintaining public confidence and achieving long-term fiscal stability.

The UK government, led by Labour's Keir Starmer, is navigating a complex economic landscape as it approaches the autumn budget. Amidst forecasts of a significant public finance deficit, Starmer has not dismissed the possibility of tax increases, despite previous commitments to maintain current rates of income tax, National Insurance, and VAT.

Economic Forecasts and Fiscal Challenges

The National Institute of Economic and Social Research (NIESR) has projected a potential shortfall of £40-50bn in the UK's public finances. This forecast suggests that the government may need to implement moderate but sustained tax rises to address the deficit. The think tank's analysis highlights the challenges faced by Chancellor Rachel Reeves, who must balance fiscal rules with economic realities.

Potential Tax Adjustments and Local Funding

Labour's Deputy Prime Minister Angela Rayner has proposed reallocating local authority funding to support more deprived areas, a move that could result in increased council tax for wealthier regions. This proposal aligns with the broader economic strategy but adds pressure on local governments to maintain services amidst budget constraints.

Starmer's Economic Vision

During a visit to Milton Keynes, Starmer sought to reassure the public by emphasizing Labour's focus on improving living standards. "Our priority is to ensure people feel better off," he stated, highlighting efforts to raise wages and reduce costs like mortgages. Despite the economic uncertainty, Starmer remains committed to stabilizing the economy and enhancing the quality of life for UK citizens.

Political and Economic Implications

Labour's economic strategy faces scrutiny as it attempts to balance fiscal responsibility with electoral promises. The NIESR report has fueled speculation about potential tax policy changes, including adjustments to VAT and income tax thresholds. While Culture Secretary Lisa Nandy has ruled out a wealth tax, the government remains under pressure to clarify its approach to addressing the fiscal deficit.

What this might mean

As the autumn budget approaches, the UK government must navigate a delicate balance between maintaining fiscal discipline and fulfilling electoral promises. The potential for tax increases looms large, with economic forecasts suggesting significant challenges ahead. Experts suggest that Labour may need to reconsider its tax pledges to address the fiscal shortfall effectively.

The political implications of breaking tax promises could be significant, potentially affecting Labour's standing with voters. However, the government's focus on improving living standards may help mitigate public concerns. As economic conditions evolve, the government's ability to adapt its strategy will be crucial in maintaining public confidence and achieving long-term fiscal stability.