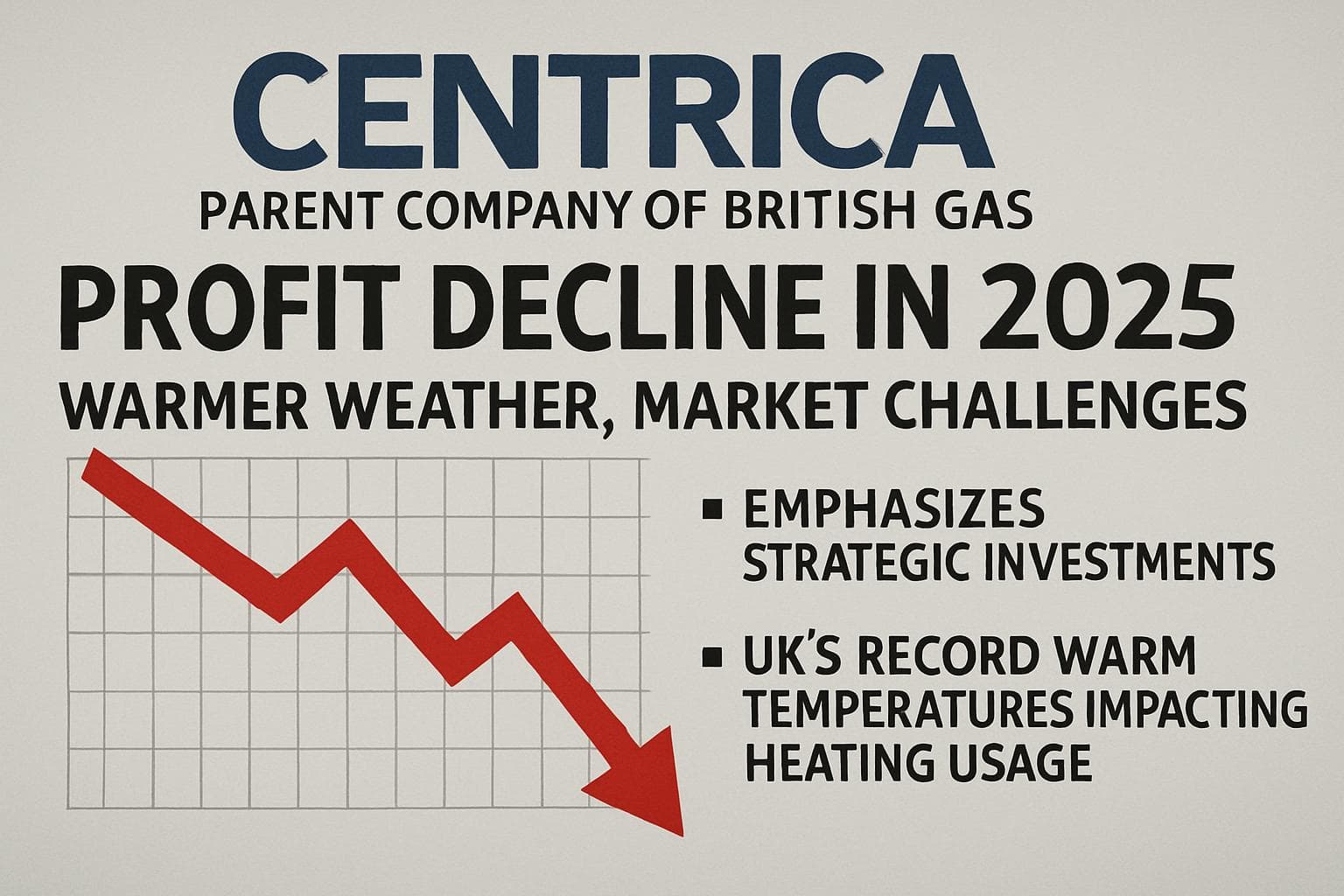

Centrica Faces Profit Decline Amid Warmer Weather and Market Challenges

Published 19 February 2026

Highlights

- Centrica's operating profits fell to £814 million in 2025, a significant drop from £1.55 billion in 2024, due to warmer weather and market conditions.

- British Gas's residential supply business saw a 39% decline in operating profits, falling to £163 million, partly due to customers switching to cheaper energy tariffs.

- Despite financial challenges, British Gas increased its customer base to 7.5 million, aided by absorbing customers from failed suppliers.

- Centrica paused its share buyback program to focus on investments like the Sizewell C nuclear project, aiming for long-term shareholder value.

- Gen Z is increasingly entering trades and construction jobs as a response to AI's impact on the job market, with employment in these sectors rising by 16.8% in January.

Centrica, the parent company of British Gas, reported a significant decline in profits for 2025, attributing the downturn to unseasonably warm weather and challenging market conditions. The company's operating profits fell to £814 million, a steep drop from £1.55 billion in 2024. This decline was mirrored in British Gas's residential supply business, where operating profits plummeted by 39% to £163 million, influenced by customers opting for cheaper fixed-rate energy tariffs.

Weather and Market Impact

The UK experienced its warmest year on record in 2025, with an average temperature of 10.09°C, leading many British Gas customers to reduce their heating usage. This, combined with a shift towards more affordable energy tariffs, significantly impacted the company's financial performance. Despite these challenges, British Gas managed to grow its customer base for the first time in over a decade, reaching 7.5 million customers. This growth was partly due to the acquisition of customers from the defunct Rebel Energy and Tomato Energy.

Strategic Shifts and Investments

In response to the financial downturn, Centrica announced a pause in its share buyback program, redirecting focus towards strategic investments. CEO Chris O'Shea emphasized the importance of projects like the Sizewell C nuclear power plant and Grain LNG in ensuring stable future earnings. "Pausing the buyback enables us to prioritize investment that creates lasting value for shareholders," O'Shea stated, highlighting the company's commitment to delivering reliable energy solutions.

Broader Economic Trends

Beyond the energy sector, the job market is witnessing shifts as younger generations seek stability in trades and construction jobs. A report from Employment Hero revealed a 16.8% increase in Gen Z employment in these sectors in January, driven by concerns over AI's impact on traditional job roles. This trend underscores a broader economic transition as industries adapt to technological advancements.

What this might mean

Looking ahead, Centrica's strategic investments in infrastructure projects like Sizewell C could stabilize its financial performance, potentially leading to more predictable earnings. However, the company must navigate ongoing market volatility and weather-related challenges. The shift in employment trends towards AI-proof jobs suggests a growing demand for skilled labor in trades, which could influence economic policies and workforce development strategies. As Centrica and other energy companies adapt to these changes, their ability to balance immediate financial pressures with long-term growth opportunities will be crucial.