UK Faces £10.9bn Loss from Covid Support Fraud, Report Warns of Future Risks

Published 9 December 2025

Highlights

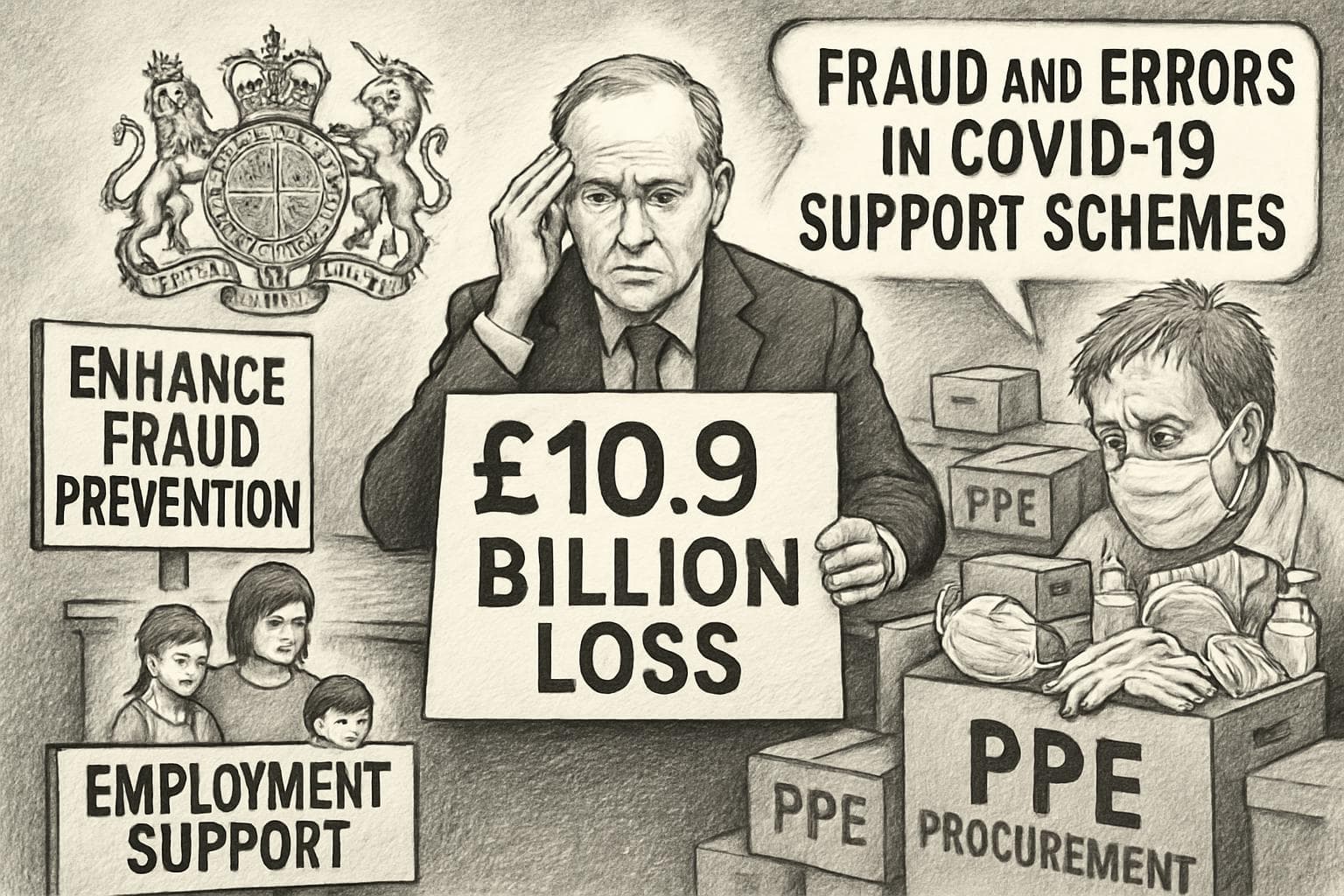

- A report reveals £10.9bn was lost to fraud and error in UK Covid support schemes, with much of it deemed "beyond recovery."

- Employment support schemes, including furlough, suffered £5bn in fraud, highlighting weak accountability and poor data quality.

- The Bounce Back Loan Scheme and PPE procurement faced significant fraud risks due to inadequate checks and over-ordering.

- The government has improved its counter-fraud capabilities but needs to embed fraud prevention in future crisis planning.

- Chancellor Rachel Reeves emphasizes recovering lost funds and strengthening fraud prevention measures.

-

Rewritten Article

Headline: UK Faces £10.9bn Loss from Covid Support Fraud, Report Warns of Future Risks

The UK government is grappling with a staggering £10.9bn loss due to fraud and errors in Covid-19 support schemes, according to a recent report by the Covid Counter Fraud Commissioner, Tom Hayhoe. The report highlights that much of this loss is now "beyond recovery," underscoring the urgent need for improved fraud prevention measures across government departments.

Fraudulent Losses and Accountability Issues

The report identifies significant vulnerabilities in the employment support schemes, including furlough and self-employment assistance, which collectively suffered £5bn in fraud. Weak accountability, poor data quality, and inadequate contracting processes were cited as primary contributors to these losses. The Bounce Back Loan Scheme, designed to support small businesses, also faced criticism for relying on self-certification without sufficient checks, leading to an estimated £1.7bn in fraud.

Challenges in PPE Procurement

The procurement of Personal Protective Equipment (PPE) during the pandemic was another area of concern, with £13.6bn spent on PPE, resulting in £10bn in losses from over-ordering and £324m in fraud. The report found that the sheer volume of orders overwhelmed the supply chain, inviting mistrust and profiteering.

Calls for Enhanced Fraud Prevention

While acknowledging improvements in counter-fraud capabilities, the report stresses that fraud prevention is still not sufficiently embedded in government practices. Hayhoe calls for the Treasury and the Public Sector Fraud Authority (PSFA) to collaborate on designing economic stimulus schemes with robust fraud controls for future crises. These schemes should be tested in crisis preparedness exercises to ensure taxpayer money is safeguarded.

Government Response and Future Measures

Chancellor Rachel Reeves has vowed to recover the lost funds and enhance fraud prevention efforts. "Leaving the front door wide open to fraud has cost the British taxpayer £10.9bn," she stated, emphasizing the need to support public services and strengthen the economy. The government plans to consider the report's recommendations and respond early next year.

-

Scenario Analysis

The report's findings could lead to significant changes in how the UK government approaches fraud prevention in future crises. By embedding fraud risk management into the design of economic stimulus schemes, the government can better protect taxpayer funds. The establishment of the PSFA and new legislation are steps in the right direction, but ongoing collaboration across departments will be crucial. As the government works to recover lost funds, it may face political pressure to demonstrate accountability and transparency in its efforts to prevent similar losses in the future.

The UK government is grappling with a staggering £10.9bn loss due to fraud and errors in Covid-19 support schemes, according to a recent report by the Covid Counter Fraud Commissioner, Tom Hayhoe. The report highlights that much of this loss is now "beyond recovery," underscoring the urgent need for improved fraud prevention measures across government departments.

Fraudulent Losses and Accountability Issues

The report identifies significant vulnerabilities in the employment support schemes, including furlough and self-employment assistance, which collectively suffered £5bn in fraud. Weak accountability, poor data quality, and inadequate contracting processes were cited as primary contributors to these losses. The Bounce Back Loan Scheme, designed to support small businesses, also faced criticism for relying on self-certification without sufficient checks, leading to an estimated £1.7bn in fraud.

Challenges in PPE Procurement

The procurement of Personal Protective Equipment (PPE) during the pandemic was another area of concern, with £13.6bn spent on PPE, resulting in £10bn in losses from over-ordering and £324m in fraud. The report found that the sheer volume of orders overwhelmed the supply chain, inviting mistrust and profiteering.

Calls for Enhanced Fraud Prevention

While acknowledging improvements in counter-fraud capabilities, the report stresses that fraud prevention is still not sufficiently embedded in government practices. Hayhoe calls for the Treasury and the Public Sector Fraud Authority (PSFA) to collaborate on designing economic stimulus schemes with robust fraud controls for future crises. These schemes should be tested in crisis preparedness exercises to ensure taxpayer money is safeguarded.

Government Response and Future Measures

Chancellor Rachel Reeves has vowed to recover the lost funds and enhance fraud prevention efforts. "Leaving the front door wide open to fraud has cost the British taxpayer £10.9bn," she stated, emphasizing the need to support public services and strengthen the economy. The government plans to consider the report's recommendations and respond early next year.

What this might mean

The report's findings could lead to significant changes in how the UK government approaches fraud prevention in future crises. By embedding fraud risk management into the design of economic stimulus schemes, the government can better protect taxpayer funds. The establishment of the PSFA and new legislation are steps in the right direction, but ongoing collaboration across departments will be crucial. As the government works to recover lost funds, it may face political pressure to demonstrate accountability and transparency in its efforts to prevent similar losses in the future.