Rising Scams in the UK: Fake Police and Car Loan Fraud Alerts

Published 17 August 2025

Highlights

- Nottinghamshire Police are investigating scams where fraudsters pose as police officers to extract money from victims.

- Bank staff in Hucknall and East Leake prevented a man from losing £5,000 to a fake police officer scam.

- The Financial Conduct Authority (FCA) warns of scams involving fake compensation claims for mis-sold car loans.

- Scammers are contacting individuals with promises of compensation, but the FCA has not yet finalized payout processes.

- Authorities advise the public to hang up immediately and report any suspicious calls or texts to Ofcom.

-

Rewritten Article

Headline: Rising Scams in the UK: Fake Police and Car Loan Fraud Alerts

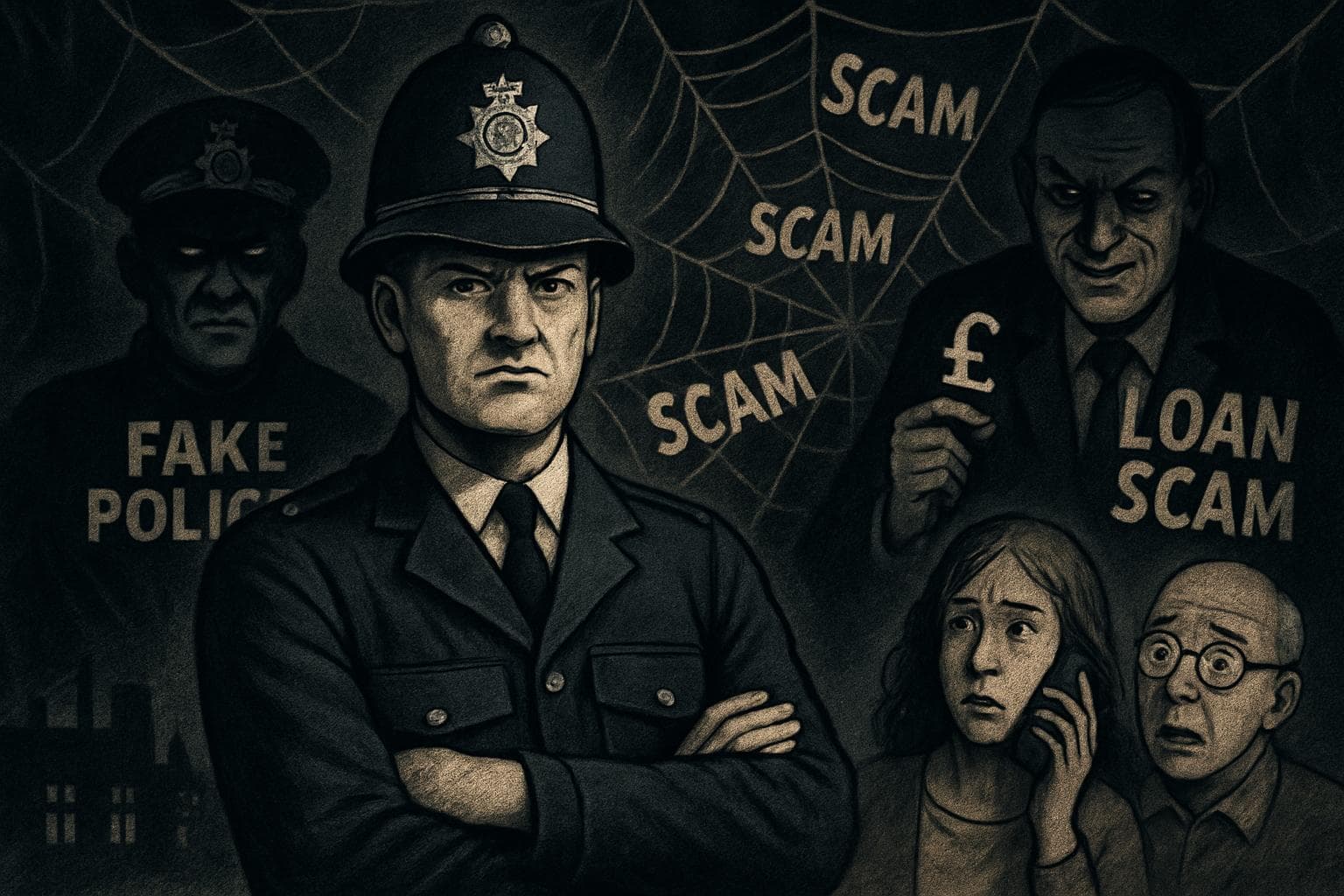

In a concerning trend, UK authorities are warning the public about two prevalent scams targeting unsuspecting individuals. Nottinghamshire Police have launched an investigation into fraudulent activities where scammers impersonate police officers to deceive victims into handing over large sums of money. Meanwhile, the Financial Conduct Authority (FCA) has issued a warning about fraudsters posing as lenders, promising compensation for mis-sold car loans.

Police Impersonation Scams

Nottinghamshire Police have reported several incidents in Hucknall and East Leake where individuals were contacted by scammers claiming to be police officers. These fraudsters instructed victims to withdraw cash or provide personal banking details under the guise of an undercover investigation. In one instance, quick-thinking bank staff prevented a man from losing £5,000. Dale Richardson, a cyber and fraud prevention officer, emphasized, "No police officer would ever request money or personal information in this manner."

Car Loan Compensation Fraud

Simultaneously, the FCA has alerted the public to scams involving fake compensation claims for mis-sold car loans. With potential payouts of up to £950 for affected motorists, fraudsters are exploiting this opportunity by contacting individuals via calls or texts, falsely claiming to represent lenders. The FCA clarified that it is still determining the compensation process, which will not be finalized until October. Until then, any unsolicited contact promising money should be treated as a scam.

Public Advisory

Both Nottinghamshire Police and the FCA urge the public to remain vigilant. If contacted by someone claiming to be a police officer or lender, individuals should hang up immediately and refrain from sharing personal information. Suspicious calls or texts can be reported to Ofcom by forwarding them to 7726. Authorities stress the importance of scam awareness to protect against financial fraud.

-

Scenario Analysis

As investigations continue, Nottinghamshire Police may uncover more victims of the fake police officer scam, potentially leading to arrests and heightened public awareness campaigns. The FCA's ongoing efforts to finalize the compensation scheme for mis-sold car loans could result in clearer guidelines for consumers, reducing the risk of falling prey to fraudsters. Experts suggest that increased collaboration between financial institutions and law enforcement could enhance fraud prevention measures, safeguarding the public against future scams.

In a concerning trend, UK authorities are warning the public about two prevalent scams targeting unsuspecting individuals. Nottinghamshire Police have launched an investigation into fraudulent activities where scammers impersonate police officers to deceive victims into handing over large sums of money. Meanwhile, the Financial Conduct Authority (FCA) has issued a warning about fraudsters posing as lenders, promising compensation for mis-sold car loans.

Police Impersonation Scams

Nottinghamshire Police have reported several incidents in Hucknall and East Leake where individuals were contacted by scammers claiming to be police officers. These fraudsters instructed victims to withdraw cash or provide personal banking details under the guise of an undercover investigation. In one instance, quick-thinking bank staff prevented a man from losing £5,000. Dale Richardson, a cyber and fraud prevention officer, emphasized, "No police officer would ever request money or personal information in this manner."

Car Loan Compensation Fraud

Simultaneously, the FCA has alerted the public to scams involving fake compensation claims for mis-sold car loans. With potential payouts of up to £950 for affected motorists, fraudsters are exploiting this opportunity by contacting individuals via calls or texts, falsely claiming to represent lenders. The FCA clarified that it is still determining the compensation process, which will not be finalized until October. Until then, any unsolicited contact promising money should be treated as a scam.

Public Advisory

Both Nottinghamshire Police and the FCA urge the public to remain vigilant. If contacted by someone claiming to be a police officer or lender, individuals should hang up immediately and refrain from sharing personal information. Suspicious calls or texts can be reported to Ofcom by forwarding them to 7726. Authorities stress the importance of scam awareness to protect against financial fraud.

What this might mean

As investigations continue, Nottinghamshire Police may uncover more victims of the fake police officer scam, potentially leading to arrests and heightened public awareness campaigns. The FCA's ongoing efforts to finalize the compensation scheme for mis-sold car loans could result in clearer guidelines for consumers, reducing the risk of falling prey to fraudsters. Experts suggest that increased collaboration between financial institutions and law enforcement could enhance fraud prevention measures, safeguarding the public against future scams.