Rising UK Unemployment Sparks Economic Concerns and Political Debate

Published 11 November 2025

Highlights

- The UK unemployment rate rose to 5% in September, the highest since the Covid pandemic, with youth unemployment being a significant factor.

- Wales' unemployment rate increased to 5.7%, prompting criticism of Labour's economic policies, while Scotland saw a slight decrease to 3.7%.

- The Office for National Statistics (ONS) data reliability has been questioned, affecting the interpretation of regional unemployment figures.

- The Bank of England is considering interest rate cuts as unemployment rises, with financial markets anticipating a possible December reduction.

- Public sector pay growth outpaces the private sector, potentially fueling debates over wage disparities and strike actions.

-

Rewritten Article

Headline: Rising UK Unemployment Sparks Economic Concerns and Political Debate

The UK's unemployment rate has climbed to 5% in the three months leading to September, marking the highest level since the Covid pandemic. This increase, partly driven by youth unemployment, has sparked significant political and economic discussions across the nation.

Regional Disparities in Unemployment

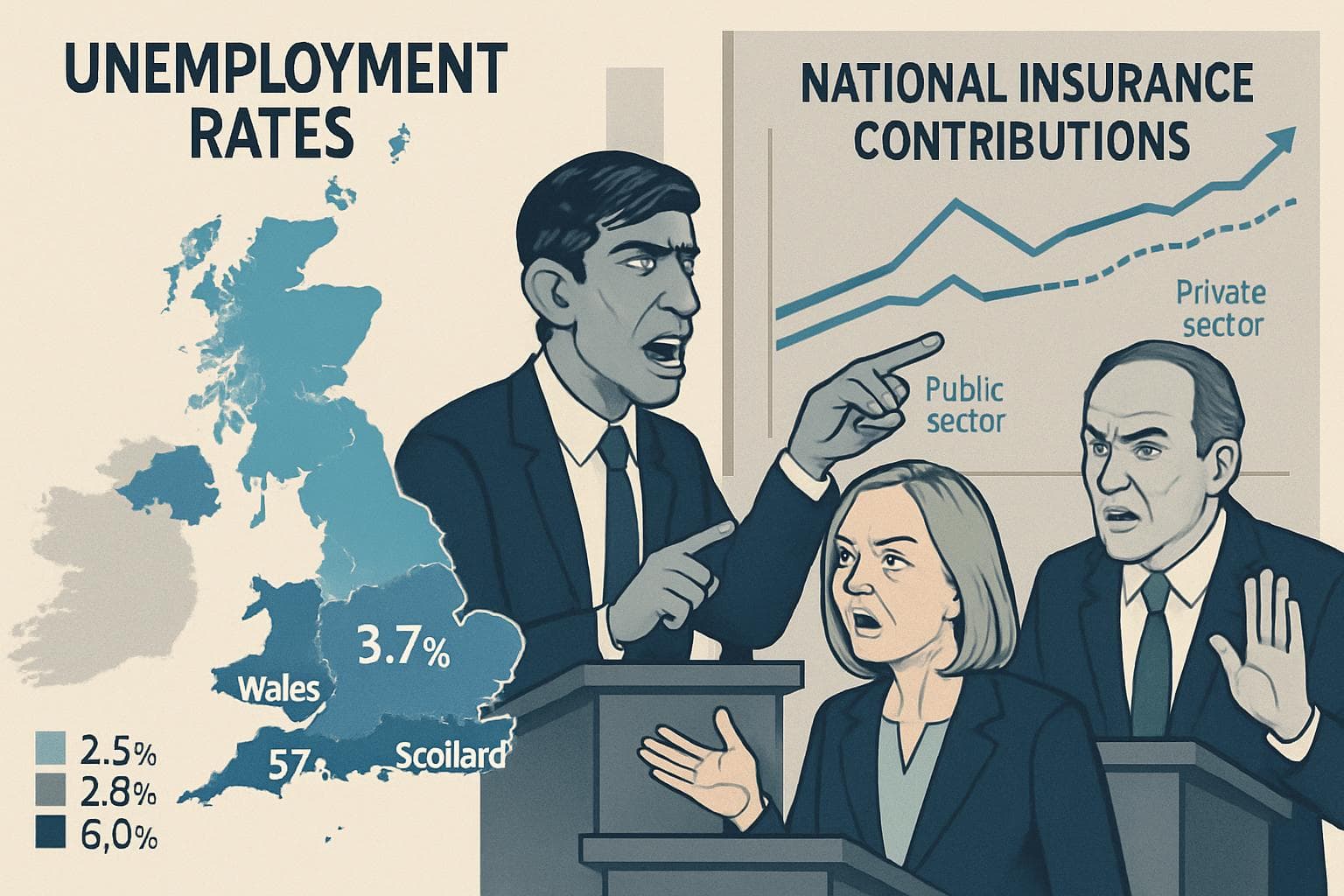

In Wales, the unemployment rate surged to 5.7%, drawing sharp criticism from the Conservative group leader, Darren Millar, who accused the Labour government of failing to manage the economy effectively. Millar highlighted policies such as speed limits and tax increases as detrimental to economic growth. In contrast, First Minister Eluned Morgan attributed the rise to external factors like Brexit and US tariffs, while questioning the reliability of the Office for National Statistics (ONS) data.

Meanwhile, Scotland experienced a slight decrease in unemployment to 3.7%. Deputy First Minister Kate Forbes emphasized the need for UK Parliament to prioritize economic growth, particularly in light of rising national insurance contributions.

Economic Implications and Policy Responses

The broader UK unemployment figures have significant implications for upcoming economic policies. With the budget set for November 26, Chancellor Rachel Reeves faces the challenge of balancing tax increases with the need to stimulate job growth. The Guardian reports that businesses are concerned about the potential impact of further national insurance hikes and minimum wage increases on employment.

The Bank of England is closely monitoring the labor market, with analysts predicting a possible interest rate cut in December. The pound's recent fall against the dollar suggests market anticipation of such a move, which could influence borrowing costs and economic activity.

Public Sector Pay and Labor Market Dynamics

The disparity between public and private sector pay growth is also under scrutiny. Public sector wages have grown by 6.8%, compared to 4.4% in the private sector, potentially leading to increased calls for wage adjustments and strike actions.

As the UK navigates these economic challenges, the reliability of ONS data remains a critical issue, with the agency acknowledging limitations in its sampling methods. This uncertainty complicates the interpretation of unemployment trends and their impact on policy decisions.

-

Scenario Analysis

Looking ahead, the UK's economic landscape could see significant shifts depending on the government's budgetary decisions and the Bank of England's monetary policy. A potential interest rate cut in December might provide some relief to businesses and consumers, but it could also signal deeper economic concerns. The ongoing debate over public sector pay disparities may intensify, especially if inflationary pressures persist. As the Labour government prepares its budget, the focus will likely be on balancing fiscal responsibility with measures to stimulate job growth and support vulnerable sectors, particularly in regions like Wales where unemployment remains a pressing issue.

The UK's unemployment rate has climbed to 5% in the three months leading to September, marking the highest level since the Covid pandemic. This increase, partly driven by youth unemployment, has sparked significant political and economic discussions across the nation.

Regional Disparities in Unemployment

In Wales, the unemployment rate surged to 5.7%, drawing sharp criticism from the Conservative group leader, Darren Millar, who accused the Labour government of failing to manage the economy effectively. Millar highlighted policies such as speed limits and tax increases as detrimental to economic growth. In contrast, First Minister Eluned Morgan attributed the rise to external factors like Brexit and US tariffs, while questioning the reliability of the Office for National Statistics (ONS) data.

Meanwhile, Scotland experienced a slight decrease in unemployment to 3.7%. Deputy First Minister Kate Forbes emphasized the need for UK Parliament to prioritize economic growth, particularly in light of rising national insurance contributions.

Economic Implications and Policy Responses

The broader UK unemployment figures have significant implications for upcoming economic policies. With the budget set for November 26, Chancellor Rachel Reeves faces the challenge of balancing tax increases with the need to stimulate job growth. The Guardian reports that businesses are concerned about the potential impact of further national insurance hikes and minimum wage increases on employment.

The Bank of England is closely monitoring the labor market, with analysts predicting a possible interest rate cut in December. The pound's recent fall against the dollar suggests market anticipation of such a move, which could influence borrowing costs and economic activity.

Public Sector Pay and Labor Market Dynamics

The disparity between public and private sector pay growth is also under scrutiny. Public sector wages have grown by 6.8%, compared to 4.4% in the private sector, potentially leading to increased calls for wage adjustments and strike actions.

As the UK navigates these economic challenges, the reliability of ONS data remains a critical issue, with the agency acknowledging limitations in its sampling methods. This uncertainty complicates the interpretation of unemployment trends and their impact on policy decisions.

What this might mean

Looking ahead, the UK's economic landscape could see significant shifts depending on the government's budgetary decisions and the Bank of England's monetary policy. A potential interest rate cut in December might provide some relief to businesses and consumers, but it could also signal deeper economic concerns. The ongoing debate over public sector pay disparities may intensify, especially if inflationary pressures persist. As the Labour government prepares its budget, the focus will likely be on balancing fiscal responsibility with measures to stimulate job growth and support vulnerable sectors, particularly in regions like Wales where unemployment remains a pressing issue.