UK Economy Faces Unexpected Contraction Amid Manufacturing Struggles

In This Article

HIGHLIGHTS

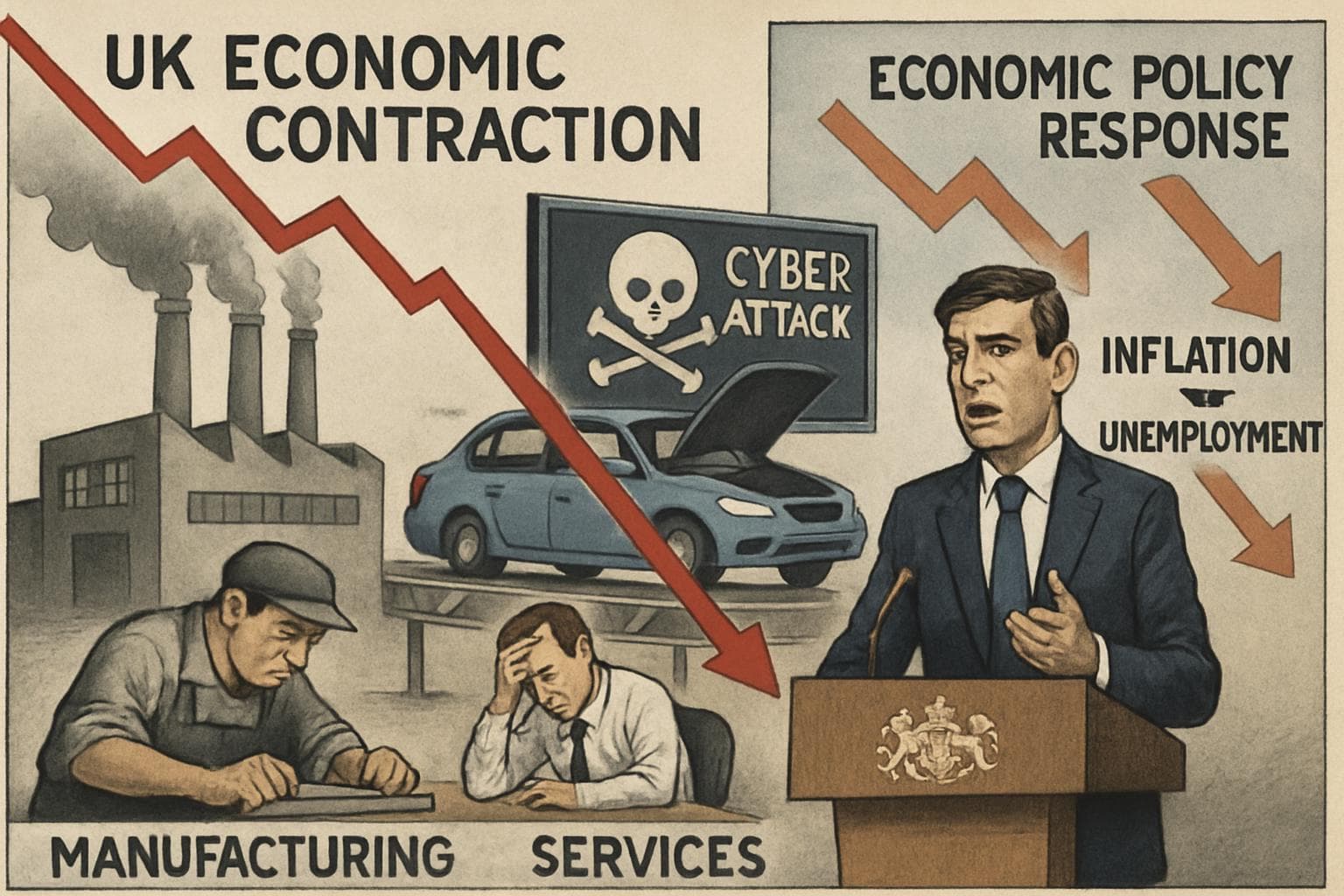

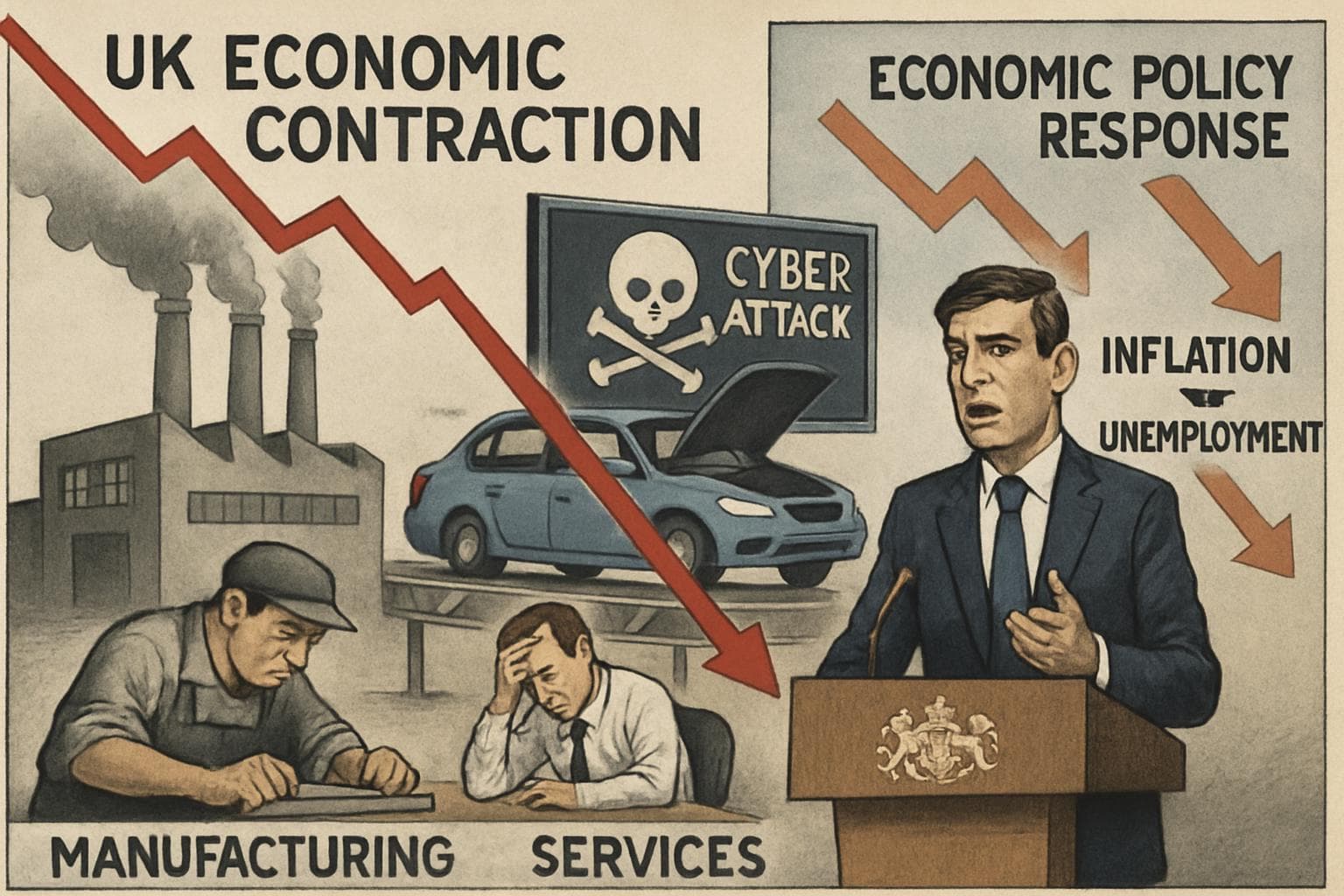

- The UK economy unexpectedly contracted by 0.1% in October, contrary to economists' predictions of growth.

- A significant decline in car manufacturing, exacerbated by a cyber-attack on Jaguar Land Rover, contributed to the economic downturn.

- The service sector saw a notable 0.3% decline, influenced by consumer caution ahead of Rachel Reeves's budget.

- The Bank of England is considering cutting interest rates amid concerns over sluggish growth and rising unemployment.

- Treasury officials emphasize efforts to boost economic growth through infrastructure investments and energy bill reductions.

The UK economy faced an unexpected contraction in October, with the Office for National Statistics (ONS) reporting a 0.1% decline in gross domestic product (GDP). This downturn defied economists' forecasts of a 0.1% growth, highlighting ongoing challenges in the manufacturing and service sectors.

Manufacturing Woes and Cyber-Attacks

A significant factor in the economic contraction was the continued weakness in the manufacturing sector, particularly in car production. The cyber-attack on Jaguar Land Rover (JLR) in September had a lingering impact, halting production across its UK plants and causing a substantial drop in vehicle manufacturing. Although there was a partial recovery in October, with a 9.5% rebound in activity, the industry remained 21.8% below August levels.

Service Sector Decline

The service sector, a dominant force in the UK economy, also experienced a 0.3% decline in output. This was largely attributed to consumer and business caution ahead of Chancellor Rachel Reeves's budget announcement. The uncertainty surrounding potential tax changes led many to delay key decisions, affecting sectors such as retail, computer programming, and consultancy.

Economic Outlook and Policy Responses

The unexpected contraction has prompted the Bank of England to consider cutting interest rates, as it grapples with a slowdown in inflation and concerns over economic growth and unemployment. The Treasury, meanwhile, remains focused on boosting growth through infrastructure investments and measures to reduce energy bills. A spokesperson emphasized the government's commitment to creating jobs and investing in public services.

Investment strategist Scott Gardner noted the "numbing effect" of budget speculation on the economy, suggesting that the uncertainty had dampened consumer and business sentiment. Shadow Chancellor Mel Stride criticized the government's economic management, attributing the weak growth to policy missteps.

WHAT THIS MIGHT MEAN

Looking ahead, the UK's economic trajectory will likely hinge on the effectiveness of government policies and the resolution of ongoing challenges in the manufacturing sector. The Bank of England's potential interest rate cuts could provide some relief, but the broader impact of Rachel Reeves's budget will be crucial in shaping consumer and business confidence. As the country navigates these economic headwinds, the government's ability to stimulate growth and manage inflation will be under close scrutiny.

Related Articles

UK Achieves Record Budget Surplus Amid Calls for Fiscal Policy Reform

UK Inflation Drops to 3% in January, Sparking Interest Rate Cut Speculation

US Supreme Court Ruling on Tariffs Sparks Uncertainty for UK and Global Trade

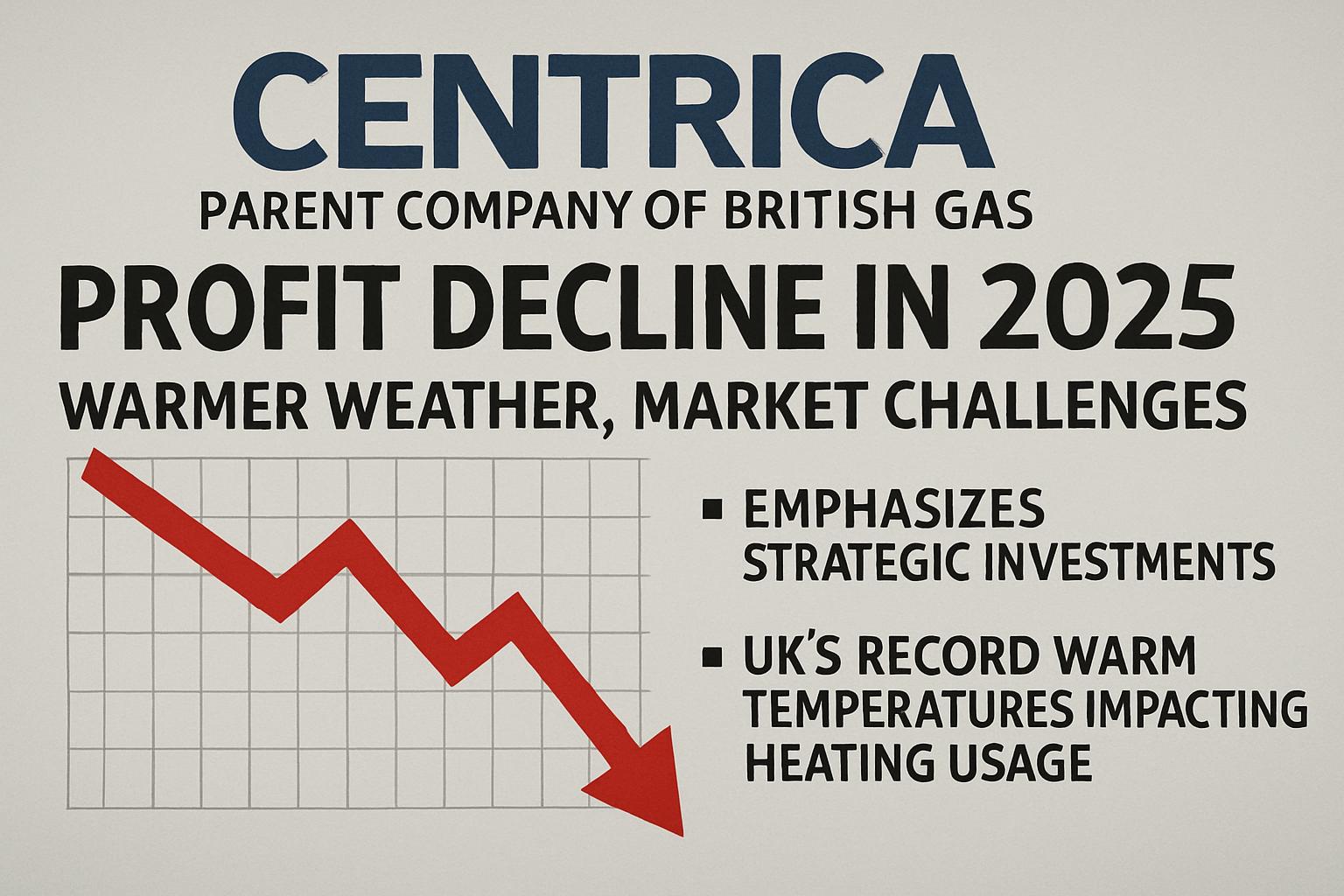

Centrica Faces Profit Decline Amid Warmer Weather and Market Challenges

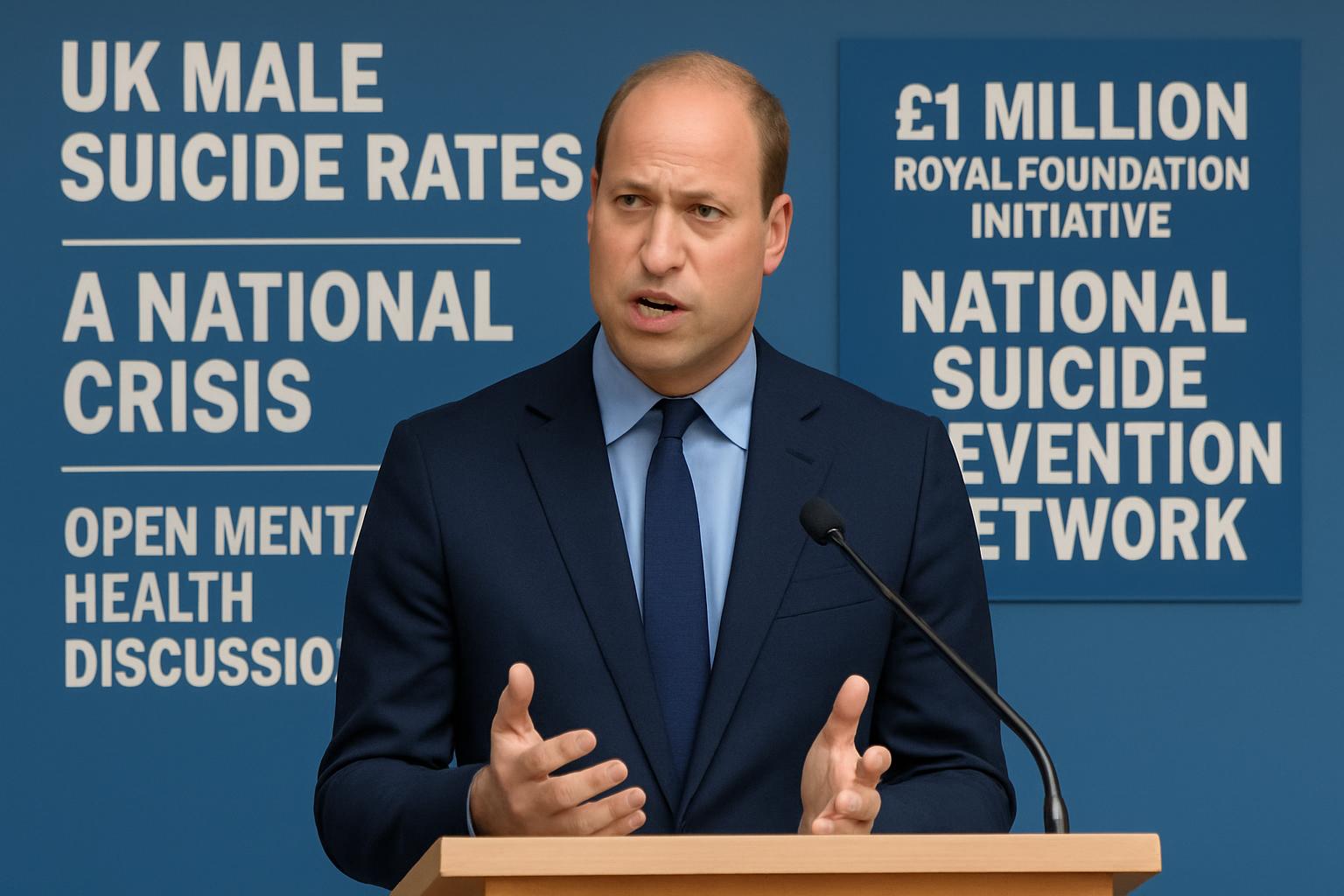

Prince William Calls for Action on UK Male Suicide Rates

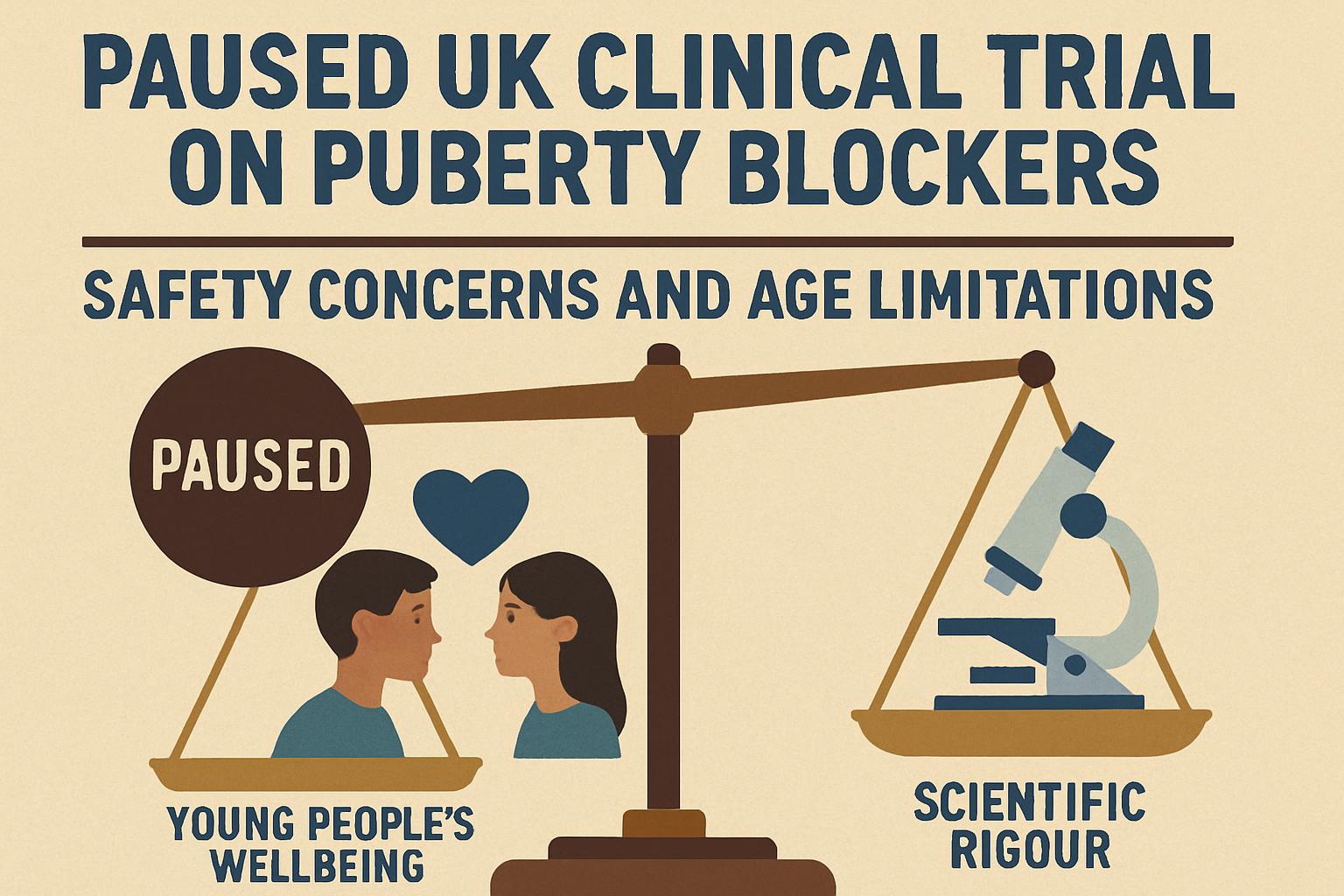

UK Clinical Trial on Puberty Blockers Paused Amid Safety Concerns

UK Economy Faces Unexpected Contraction Amid Manufacturing Struggles

In This Article

Daniel Rivera| Published

Daniel Rivera| Published HIGHLIGHTS

- The UK economy unexpectedly contracted by 0.1% in October, contrary to economists' predictions of growth.

- A significant decline in car manufacturing, exacerbated by a cyber-attack on Jaguar Land Rover, contributed to the economic downturn.

- The service sector saw a notable 0.3% decline, influenced by consumer caution ahead of Rachel Reeves's budget.

- The Bank of England is considering cutting interest rates amid concerns over sluggish growth and rising unemployment.

- Treasury officials emphasize efforts to boost economic growth through infrastructure investments and energy bill reductions.

The UK economy faced an unexpected contraction in October, with the Office for National Statistics (ONS) reporting a 0.1% decline in gross domestic product (GDP). This downturn defied economists' forecasts of a 0.1% growth, highlighting ongoing challenges in the manufacturing and service sectors.

Manufacturing Woes and Cyber-Attacks

A significant factor in the economic contraction was the continued weakness in the manufacturing sector, particularly in car production. The cyber-attack on Jaguar Land Rover (JLR) in September had a lingering impact, halting production across its UK plants and causing a substantial drop in vehicle manufacturing. Although there was a partial recovery in October, with a 9.5% rebound in activity, the industry remained 21.8% below August levels.

Service Sector Decline

The service sector, a dominant force in the UK economy, also experienced a 0.3% decline in output. This was largely attributed to consumer and business caution ahead of Chancellor Rachel Reeves's budget announcement. The uncertainty surrounding potential tax changes led many to delay key decisions, affecting sectors such as retail, computer programming, and consultancy.

Economic Outlook and Policy Responses

The unexpected contraction has prompted the Bank of England to consider cutting interest rates, as it grapples with a slowdown in inflation and concerns over economic growth and unemployment. The Treasury, meanwhile, remains focused on boosting growth through infrastructure investments and measures to reduce energy bills. A spokesperson emphasized the government's commitment to creating jobs and investing in public services.

Investment strategist Scott Gardner noted the "numbing effect" of budget speculation on the economy, suggesting that the uncertainty had dampened consumer and business sentiment. Shadow Chancellor Mel Stride criticized the government's economic management, attributing the weak growth to policy missteps.

WHAT THIS MIGHT MEAN

Looking ahead, the UK's economic trajectory will likely hinge on the effectiveness of government policies and the resolution of ongoing challenges in the manufacturing sector. The Bank of England's potential interest rate cuts could provide some relief, but the broader impact of Rachel Reeves's budget will be crucial in shaping consumer and business confidence. As the country navigates these economic headwinds, the government's ability to stimulate growth and manage inflation will be under close scrutiny.

Related Articles

UK Achieves Record Budget Surplus Amid Calls for Fiscal Policy Reform

UK Inflation Drops to 3% in January, Sparking Interest Rate Cut Speculation

US Supreme Court Ruling on Tariffs Sparks Uncertainty for UK and Global Trade

Centrica Faces Profit Decline Amid Warmer Weather and Market Challenges

Prince William Calls for Action on UK Male Suicide Rates

UK Clinical Trial on Puberty Blockers Paused Amid Safety Concerns