Rising Food Prices Strain UK Households and Retailers

Published 29 July 2025

Highlights

- UK food prices rose by 4% in July, driven by increased costs of meat and tea, according to the British Retail Consortium (BRC).

- Household grocery bills are expected to rise by £275 this year, with cupboard goods inflation reaching 5.1%.

- Meat prices surged by 17% in the year to June, while butter prices increased by 18.2%, adding pressure on household budgets.

- Retailers face challenges as economic uncertainty and rising prices deter shoppers from high street stores.

- The Consumer Price Index (CPI) showed UK inflation at 3.6% in June, with food and non-alcoholic beverage prices rising by 4.5%.

-

Rewritten Article

Rising Food Prices Strain UK Households and Retailers

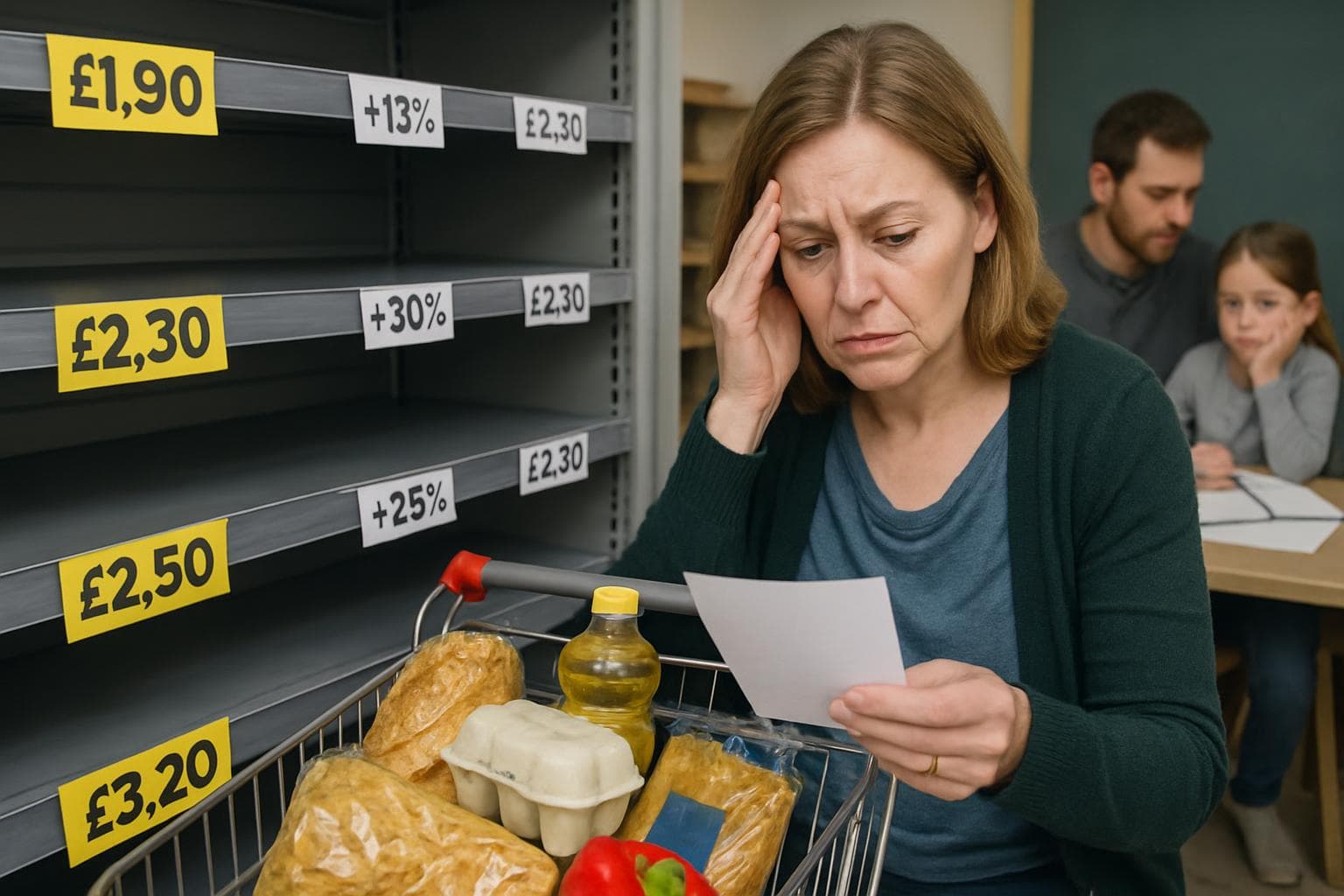

The cost of living in the UK continues to climb as food prices rose by 4% in July, marking the sixth consecutive month of inflation driven by increased costs of staples such as meat and tea. The British Retail Consortium (BRC) reported that tighter global supplies have significantly impacted wholesale prices, leading to higher costs for consumers. This trend is expected to add £275 to household grocery bills this year.

Impact on Household Budgets

The rising prices have put considerable pressure on household finances, with cupboard goods inflation reaching 5.1% in July. Meat prices alone surged by 17% in the year to June, while butter saw an 18.2% increase over the past year. Helen Dickinson, chief executive of the BRC, highlighted that these staples have been hit hardest by global supply constraints, contributing to the overall rise in shop price inflation.

Challenges for Retailers

Retailers are grappling with the dual challenges of economic uncertainty and rising prices, which have deterred shoppers from returning to high street stores. A survey by the Confederation of British Industry (CBI) revealed that sales volumes have been falling since October 2024, with retailers expecting this trend to continue. Martin Sartorius, a principal economist at the CBI, noted that higher price pressures and economic uncertainty are weighing on household demand.

Inflation and Consumer Behavior

The Office for National Statistics (ONS) reported that the Consumer Price Index (CPI) showed UK inflation at 3.6% in June, with food and non-alcoholic beverage prices rising by 4.5%. Mike Watkins from NIQ pointed out that while price competition and promotional activities offer some relief, consumers are increasingly cautious with their spending, opting to save rather than spend amid the uncertain economic outlook.

-

Scenario Analysis

Looking ahead, the persistent rise in food prices and inflation could lead to further economic challenges for both consumers and retailers. If global supply issues continue, staples like meat and tea may remain expensive, exacerbating the financial strain on households. Retailers may need to innovate and adapt their strategies to attract cost-conscious consumers, potentially through increased promotions or diversifying product offerings.

Economists warn that if inflation remains unchecked, it could lead to reduced consumer spending, impacting economic growth. Policymakers may need to consider interventions to stabilize prices and support households, especially those most affected by the rising cost of living. As the situation evolves, close monitoring of inflation trends and consumer behavior will be crucial in navigating these economic challenges.

The cost of living in the UK continues to climb as food prices rose by 4% in July, marking the sixth consecutive month of inflation driven by increased costs of staples such as meat and tea. The British Retail Consortium (BRC) reported that tighter global supplies have significantly impacted wholesale prices, leading to higher costs for consumers. This trend is expected to add £275 to household grocery bills this year.

Impact on Household Budgets

The rising prices have put considerable pressure on household finances, with cupboard goods inflation reaching 5.1% in July. Meat prices alone surged by 17% in the year to June, while butter saw an 18.2% increase over the past year. Helen Dickinson, chief executive of the BRC, highlighted that these staples have been hit hardest by global supply constraints, contributing to the overall rise in shop price inflation.

Challenges for Retailers

Retailers are grappling with the dual challenges of economic uncertainty and rising prices, which have deterred shoppers from returning to high street stores. A survey by the Confederation of British Industry (CBI) revealed that sales volumes have been falling since October 2024, with retailers expecting this trend to continue. Martin Sartorius, a principal economist at the CBI, noted that higher price pressures and economic uncertainty are weighing on household demand.

Inflation and Consumer Behavior

The Office for National Statistics (ONS) reported that the Consumer Price Index (CPI) showed UK inflation at 3.6% in June, with food and non-alcoholic beverage prices rising by 4.5%. Mike Watkins from NIQ pointed out that while price competition and promotional activities offer some relief, consumers are increasingly cautious with their spending, opting to save rather than spend amid the uncertain economic outlook.

What this might mean

Looking ahead, the persistent rise in food prices and inflation could lead to further economic challenges for both consumers and retailers. If global supply issues continue, staples like meat and tea may remain expensive, exacerbating the financial strain on households. Retailers may need to innovate and adapt their strategies to attract cost-conscious consumers, potentially through increased promotions or diversifying product offerings.

Economists warn that if inflation remains unchecked, it could lead to reduced consumer spending, impacting economic growth. Policymakers may need to consider interventions to stabilize prices and support households, especially those most affected by the rising cost of living. As the situation evolves, close monitoring of inflation trends and consumer behavior will be crucial in navigating these economic challenges.