UK Inflation Drops to 3.2%, Paving Way for Expected Interest Rate Cut

Published 17 December 2025

Highlights

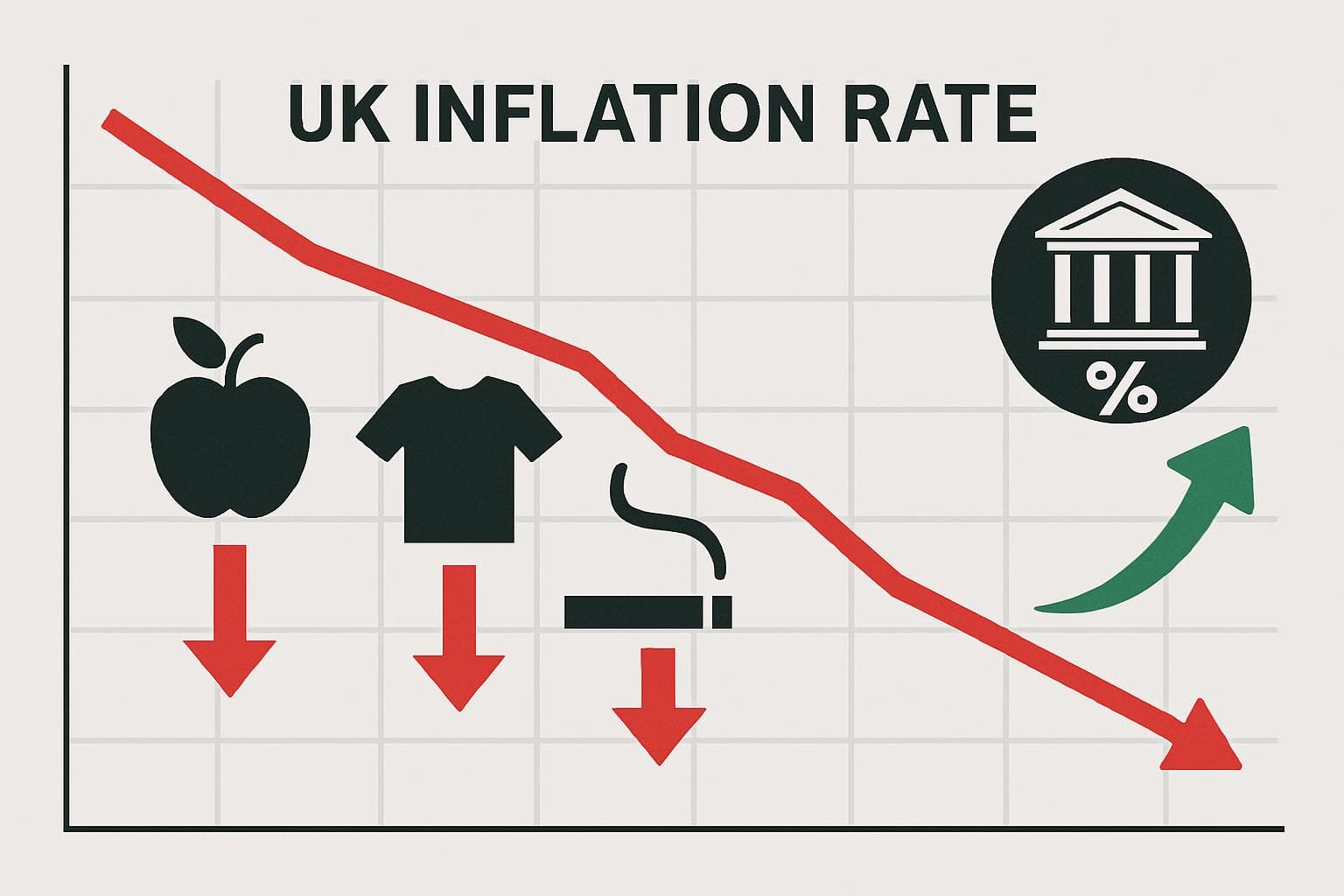

- UK inflation fell to 3.2% in November, the lowest in eight months, driven by decreases in food, clothing, and tobacco prices.

- The Bank of England is expected to cut interest rates from 4% to 3.75% amid easing inflationary pressures and economic slowdown.

- Chancellor Rachel Reeves emphasized the government's commitment to reducing the cost of living, highlighting recent budget measures.

- Core inflation, excluding volatile items like energy and food, also decreased, strengthening the case for a rate cut.

- The economic outlook remains fragile, with rising unemployment and a slowing jobs market, prompting calls for further rate cuts.

-

Rewritten Article

Headline: UK Inflation Drops to 3.2%, Paving Way for Expected Interest Rate Cut

In a significant economic development, the UK's inflation rate fell to 3.2% in November, marking its lowest level in eight months. This decline, driven by reductions in food, clothing, and tobacco prices, has bolstered expectations for an interest rate cut by the Bank of England on Thursday. The Office for National Statistics (ONS) reported that the consumer prices index eased from 3.6% in October, surpassing economists' predictions of a modest drop to 3.5%.

Drivers of Inflation Decline

The primary contributors to the inflation slowdown were lower prices in food, alcohol, and clothing. Grant Fitzner, the ONS chief economist, noted significant decreases in items such as cakes, biscuits, and breakfast cereals. Tobacco prices also eased, contributing to the overall reduction. The Bank of England, which has held interest rates at 4% in recent meetings, is now expected to announce a cut to 3.75%, amid a 90% probability forecasted by financial markets.

Government's Response to Cost of Living

Chancellor Rachel Reeves welcomed the inflation drop, emphasizing the government's focus on alleviating the cost of living pressures. Recent budget measures, including freezing rail fares and prescription charges, aim to further reduce household expenses. Reeves highlighted that these initiatives could potentially cut headline inflation by half a percentage point next year.

Economic Context and Future Outlook

Despite the positive inflation figures, the UK's economic landscape remains challenging. Core inflation, which excludes volatile items like energy and food, has also decreased, reinforcing the case for a rate cut. However, the economy faces headwinds with rising unemployment and a slowing jobs market. The Trades Union Congress (TUC) has called for a series of rate cuts to support households and businesses, arguing that the Bank of England has been overly cautious.

-

Scenario Analysis

The anticipated interest rate cut by the Bank of England could provide much-needed relief to borrowers and stimulate economic activity. However, the broader economic context remains precarious, with potential implications for future monetary policy decisions. If inflation continues to ease and economic indicators remain weak, further rate cuts may be on the horizon. Experts suggest that sustained reductions in interest rates could boost consumer confidence and encourage investment, potentially aiding in the recovery of the UK's fragile economy. Nonetheless, policymakers will need to balance these measures against the risks of inflationary resurgence and fiscal constraints.

In a significant economic development, the UK's inflation rate fell to 3.2% in November, marking its lowest level in eight months. This decline, driven by reductions in food, clothing, and tobacco prices, has bolstered expectations for an interest rate cut by the Bank of England on Thursday. The Office for National Statistics (ONS) reported that the consumer prices index eased from 3.6% in October, surpassing economists' predictions of a modest drop to 3.5%.

Drivers of Inflation Decline

The primary contributors to the inflation slowdown were lower prices in food, alcohol, and clothing. Grant Fitzner, the ONS chief economist, noted significant decreases in items such as cakes, biscuits, and breakfast cereals. Tobacco prices also eased, contributing to the overall reduction. The Bank of England, which has held interest rates at 4% in recent meetings, is now expected to announce a cut to 3.75%, amid a 90% probability forecasted by financial markets.

Government's Response to Cost of Living

Chancellor Rachel Reeves welcomed the inflation drop, emphasizing the government's focus on alleviating the cost of living pressures. Recent budget measures, including freezing rail fares and prescription charges, aim to further reduce household expenses. Reeves highlighted that these initiatives could potentially cut headline inflation by half a percentage point next year.

Economic Context and Future Outlook

Despite the positive inflation figures, the UK's economic landscape remains challenging. Core inflation, which excludes volatile items like energy and food, has also decreased, reinforcing the case for a rate cut. However, the economy faces headwinds with rising unemployment and a slowing jobs market. The Trades Union Congress (TUC) has called for a series of rate cuts to support households and businesses, arguing that the Bank of England has been overly cautious.

What this might mean

The anticipated interest rate cut by the Bank of England could provide much-needed relief to borrowers and stimulate economic activity. However, the broader economic context remains precarious, with potential implications for future monetary policy decisions. If inflation continues to ease and economic indicators remain weak, further rate cuts may be on the horizon. Experts suggest that sustained reductions in interest rates could boost consumer confidence and encourage investment, potentially aiding in the recovery of the UK's fragile economy. Nonetheless, policymakers will need to balance these measures against the risks of inflationary resurgence and fiscal constraints.