Federal Reserve Cuts Interest Rates Amid Economic Uncertainty and Internal Divisions

Published 10 December 2025

Highlights

- The US Federal Reserve has reduced interest rates by 0.25 percentage points, marking the third cut this year, amid internal disagreements.

- The new interest rate range is 3.50% to 3.75%, the lowest in three years, as the Fed balances inflation concerns with a weakening job market.

- Fed Chair Jerome Powell highlighted the need for careful analysis of economic data post-government shutdown, which has affected data collection.

- President Trump has criticized the Fed's decision, advocating for more significant cuts to boost the US economy.

- The Fed's future rate cuts remain uncertain, with projections suggesting only one potential cut next year, pending new economic data.

-

Rewritten Article

Headline: Federal Reserve Cuts Interest Rates Amid Economic Uncertainty and Internal Divisions

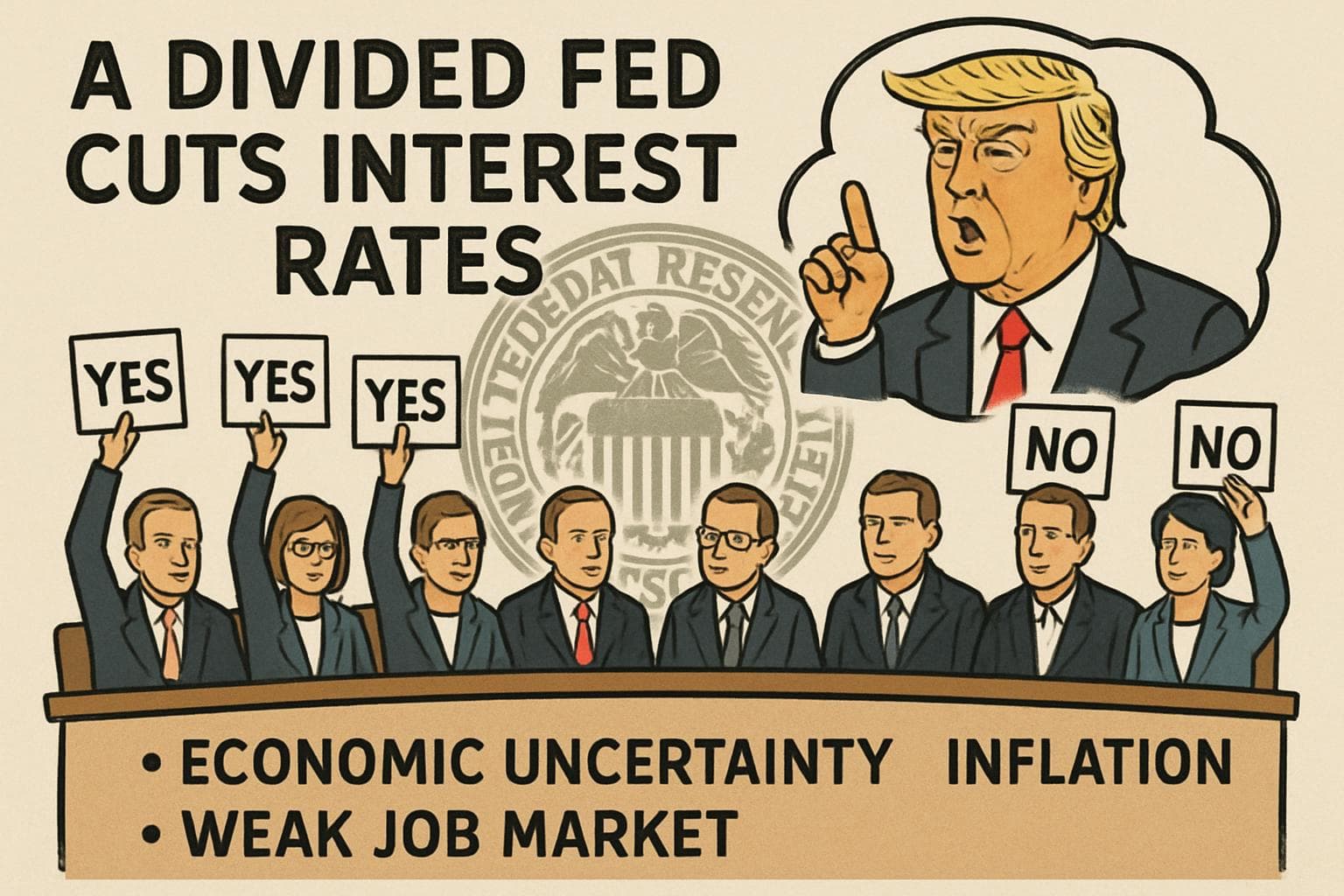

The US Federal Reserve has announced a reduction in interest rates by 0.25 percentage points, bringing the target range to 3.50% to 3.75%. This marks the third rate cut this year as the central bank grapples with internal divisions and economic uncertainties. The decision, made on Wednesday, reflects ongoing debates within the Federal Open Market Committee (FOMC) about how best to manage the US economy amid rising inflation and a weakening job market.

Internal Divisions and Economic Challenges

The vote to lower rates was not unanimous, with a nine-to-three split among FOMC members. This division underscores the challenges facing the Fed as it navigates economic disruptions, including tariffs and changes in the labor force due to immigration policies. Fed Chair Jerome Powell emphasized the need for unity but acknowledged the complexity of balancing inflation concerns with employment issues.

Impact of Government Shutdown on Data Collection

The recent government shutdown has further complicated the Fed's task, as it disrupted the collection of crucial economic data. Powell noted that the lack of comprehensive data requires a cautious approach in interpreting upcoming reports on prices and the labor market. "We are well-positioned to wait to see how the economy evolves," Powell stated, highlighting the importance of careful analysis in the coming months.

Trump's Criticism and Future Projections

President Donald Trump has been vocal in his criticism of the Fed's decision, advocating for more aggressive rate cuts to stimulate the economy. "Our rates should be much lower," Trump remarked, expressing frustration with the current monetary policy. Despite these pressures, the Fed's projections suggest only one potential rate cut next year, contingent on new economic data.

Balancing Inflation and Employment Concerns

The Fed faces a delicate balancing act as it addresses inflation, which reached 3% in September, and a job market showing signs of weakness. The unemployment rate rose to 4.4% in September, prompting the Fed to focus on stimulating employment through lower borrowing costs. However, the central bank remains cautious, wary of the inflationary pressures exacerbated by tariffs.

-

Scenario Analysis

Looking ahead, the Federal Reserve's approach to interest rates will likely hinge on forthcoming economic data and the evolving political landscape. With Jerome Powell's term as chair ending in May, President Trump may nominate a successor aligned with his economic vision, potentially influencing future monetary policy. Economists will closely monitor the Fed's actions as they navigate the dual challenges of inflation and employment, with the potential for further rate adjustments depending on economic indicators. The ongoing debate within the Fed highlights the complexity of managing the US economy in a time of significant uncertainty.

The US Federal Reserve has announced a reduction in interest rates by 0.25 percentage points, bringing the target range to 3.50% to 3.75%. This marks the third rate cut this year as the central bank grapples with internal divisions and economic uncertainties. The decision, made on Wednesday, reflects ongoing debates within the Federal Open Market Committee (FOMC) about how best to manage the US economy amid rising inflation and a weakening job market.

Internal Divisions and Economic Challenges

The vote to lower rates was not unanimous, with a nine-to-three split among FOMC members. This division underscores the challenges facing the Fed as it navigates economic disruptions, including tariffs and changes in the labor force due to immigration policies. Fed Chair Jerome Powell emphasized the need for unity but acknowledged the complexity of balancing inflation concerns with employment issues.

Impact of Government Shutdown on Data Collection

The recent government shutdown has further complicated the Fed's task, as it disrupted the collection of crucial economic data. Powell noted that the lack of comprehensive data requires a cautious approach in interpreting upcoming reports on prices and the labor market. "We are well-positioned to wait to see how the economy evolves," Powell stated, highlighting the importance of careful analysis in the coming months.

Trump's Criticism and Future Projections

President Donald Trump has been vocal in his criticism of the Fed's decision, advocating for more aggressive rate cuts to stimulate the economy. "Our rates should be much lower," Trump remarked, expressing frustration with the current monetary policy. Despite these pressures, the Fed's projections suggest only one potential rate cut next year, contingent on new economic data.

Balancing Inflation and Employment Concerns

The Fed faces a delicate balancing act as it addresses inflation, which reached 3% in September, and a job market showing signs of weakness. The unemployment rate rose to 4.4% in September, prompting the Fed to focus on stimulating employment through lower borrowing costs. However, the central bank remains cautious, wary of the inflationary pressures exacerbated by tariffs.

What this might mean

Looking ahead, the Federal Reserve's approach to interest rates will likely hinge on forthcoming economic data and the evolving political landscape. With Jerome Powell's term as chair ending in May, President Trump may nominate a successor aligned with his economic vision, potentially influencing future monetary policy. Economists will closely monitor the Fed's actions as they navigate the dual challenges of inflation and employment, with the potential for further rate adjustments depending on economic indicators. The ongoing debate within the Fed highlights the complexity of managing the US economy in a time of significant uncertainty.