US Government's Revenue Share Deal with Chip Giants Raises Concerns

Published 11 August 2025

Highlights

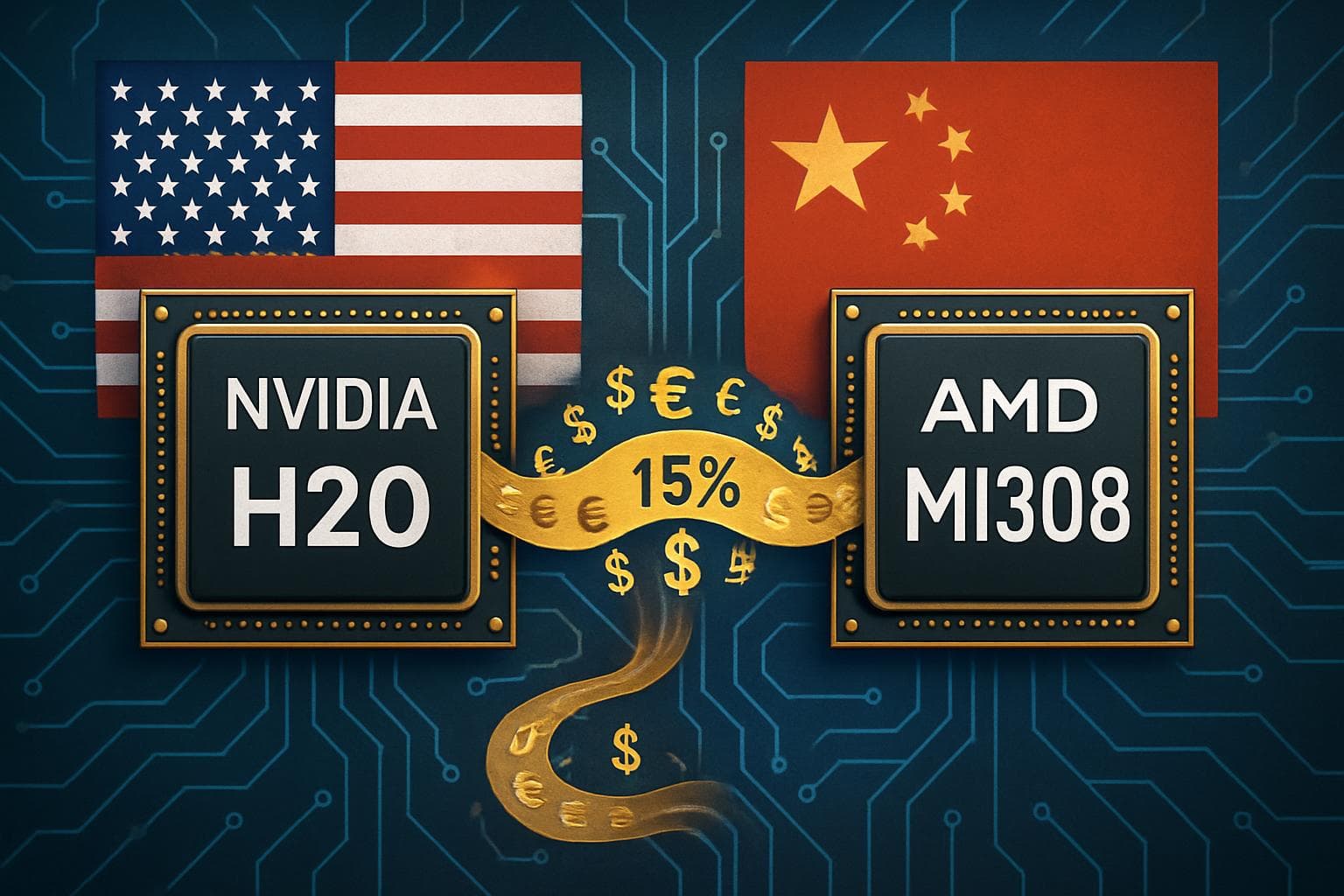

- Nvidia and AMD have agreed to pay the US government 15% of their revenue from selling certain AI chips to China, a move seen as unprecedented by industry experts.

- The deal follows the lifting of a previous ban on these chip sales, initially imposed due to national security concerns under the Biden administration.

- The agreement has sparked debate over its implications for US companies operating in China, with some viewing it as a form of export tax.

- Nvidia's H20 and AMD's MI308 chips, designed for the Chinese market, are less advanced but crucial for accessing China's rapidly growing AI sector.

- President Trump hinted at potential future negotiations for more advanced Nvidia chips, despite existing concerns over national security.

In a groundbreaking move, Nvidia and AMD have agreed to share 15% of their revenue from selling specific AI chips to China with the US government. This arrangement, announced recently, has drawn mixed reactions from industry experts and policymakers, who describe it as both unprecedented and potentially problematic.

Background and Context

The deal comes after the Biden administration lifted a ban on the sale of these chips to China, a restriction initially imposed due to national security concerns. The chips in question, Nvidia's H20 and AMD's MI308, were specifically developed to comply with export limitations and cater to the lucrative Chinese market. Despite being less powerful than their flagship counterparts, these chips are essential for companies aiming to tap into China's booming AI industry, projected to reach $100 billion this year.

Industry and Political Reactions

The agreement has sparked a debate over its implications for US businesses operating in China. Critics argue that the 15% revenue share resembles an export tax, potentially setting a precedent for other companies. Trade expert Deborah Elms described the situation as "unprecedented," while others worry about the message it sends to firms like Apple and Tesla that rely on China as a key market.

President Trump defended the deal, emphasizing that the revenue would benefit the country rather than himself personally. He also hinted at possible future negotiations for a more advanced Nvidia chip, the Blackwell, albeit in a downgraded form to address security concerns.

Implications for the AI Market

Nvidia and AMD's ability to resume chip sales to China is a significant boost, given the country's rapid AI investment growth. However, the financial impact of the 15% revenue cut remains a concern for investors, as it could affect the companies' bottom lines and future earnings projections.

What this might mean

The US government's decision to take a cut from chip sales to China could have far-reaching implications. If this approach is seen as a form of export tax, it may deter other companies from engaging in similar deals, potentially impacting US-China trade relations. Furthermore, the ongoing negotiations for more advanced chips could reignite debates over national security and technological competitiveness.

Experts suggest that the situation could lead to increased scrutiny of US tech exports to China, with policymakers balancing economic interests against security concerns. As the AI market continues to evolve, the outcome of these negotiations could set a precedent for future trade agreements and influence the global tech landscape.