Former Fed Chairs Condemn DOJ Probe into Jerome Powell Amidst Trump Pressure

Published 12 January 2026

Highlights

- Former Fed chairs, including Janet Yellen, Ben Bernanke, and Alan Greenspan, have condemned the Department of Justice's investigation into Jerome Powell as a threat to the Federal Reserve's independence.

- The investigation, linked to Powell's testimony on Fed building renovations, is seen as part of Trump's broader campaign to pressure the central bank to lower interest rates.

- Several Republican lawmakers have criticized the investigation, with some threatening to block Fed nominations until the matter is resolved.

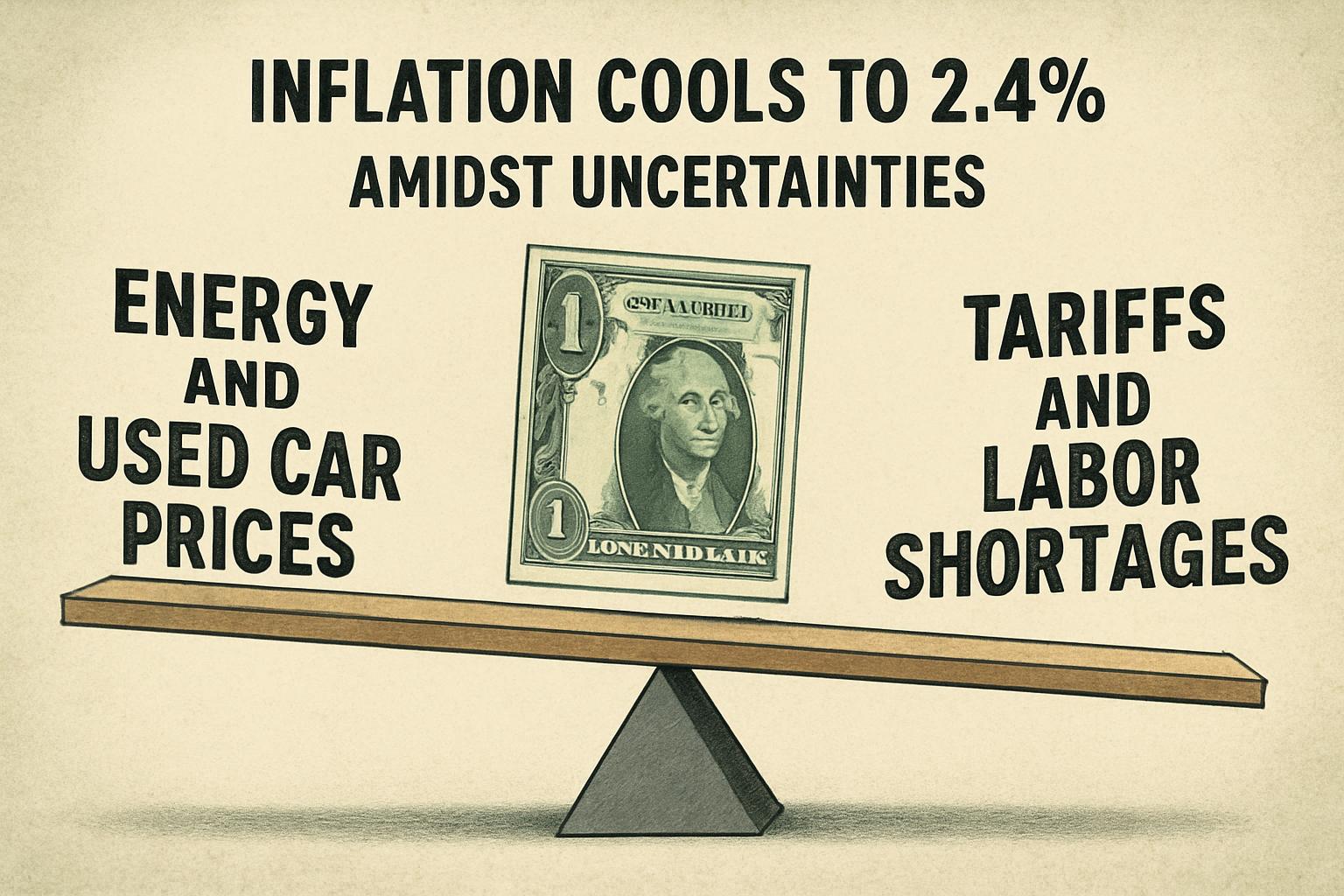

- Economists warn that political interference in the Fed could lead to 1970s-style inflation and a global financial backlash.

- Elizabeth Warren has criticized Trump's attempts to control the Fed, arguing it undermines America's global standing.

-

Rewritten Article

Headline: Former Fed Chairs Condemn DOJ Probe into Jerome Powell Amidst Trump Pressure

In a rare unified stance, former Federal Reserve chairs have strongly criticized the Department of Justice's (DoJ) criminal investigation into current Fed Chair Jerome Powell, labeling it an unprecedented threat to the central bank's independence. This investigation, which emerged after Powell's testimony regarding renovations to the Fed's historic buildings, is perceived as part of a broader campaign by the Trump administration to exert control over monetary policy.

Background and Reactions

The investigation was disclosed by Powell in an unscheduled video statement, where he described the DoJ's actions as a pretext for political pressure. Powell asserted that the probe is not genuinely about his testimony or the renovation costs but rather about the administration's dissatisfaction with the Fed's interest rate decisions. The central bank had lowered its key lending rate three times in 2025, yet President Trump has persistently criticized these cuts as insufficient.

Former Fed chairs, including Janet Yellen, Ben Bernanke, and Alan Greenspan, along with other former officials, have rallied behind Powell. In a joint statement, they warned that such prosecutorial attacks could have "highly negative consequences" for the economy, drawing parallels to monetary policies in countries with weaker institutions.

Political and Economic Implications

The investigation has sparked a political backlash, with several Republican lawmakers, including Senator Thom Tillis, threatening to block all Federal Reserve nominations until the legal matter is resolved. Tillis and others have voiced concerns that the probe undermines the Fed's independence, a sentiment echoed by Democratic Senator Elizabeth Warren, who warned that Trump's actions could damage America's global reputation.

Economists have also raised alarms, suggesting that political interference in the Fed could lead to inflation reminiscent of the 1970s. Atakan Bakiskan, a US economist, cautioned that if the Fed succumbs to political pressure, it could destabilize financial markets and deter foreign investment.

The Broader Context

This investigation is the latest in a series of confrontations between Trump and the Fed. The President has repeatedly urged Powell to lower interest rates to reduce government borrowing costs and stimulate the economy. Despite these pressures, Powell has maintained that the Fed's decisions are based on economic data rather than political preferences.

-

Scenario Analysis

The ongoing investigation into Jerome Powell could have significant implications for the Federal Reserve's future operations and its perceived independence. If the DoJ proceeds with charges, it could set a precedent for increased political interference in monetary policy, potentially destabilizing financial markets. Economists warn that such actions could lead to inflationary pressures similar to those experienced in the 1970s, affecting both domestic and global economies.

Politically, the investigation may further polarize opinions on the Fed's role and independence, influencing future nominations and policy decisions. As Powell's term nears its end, the selection of his successor will likely become a focal point of contention, with implications for the Fed's policy direction and its ability to navigate economic challenges.

In a rare unified stance, former Federal Reserve chairs have strongly criticized the Department of Justice's (DoJ) criminal investigation into current Fed Chair Jerome Powell, labeling it an unprecedented threat to the central bank's independence. This investigation, which emerged after Powell's testimony regarding renovations to the Fed's historic buildings, is perceived as part of a broader campaign by the Trump administration to exert control over monetary policy.

Background and Reactions

The investigation was disclosed by Powell in an unscheduled video statement, where he described the DoJ's actions as a pretext for political pressure. Powell asserted that the probe is not genuinely about his testimony or the renovation costs but rather about the administration's dissatisfaction with the Fed's interest rate decisions. The central bank had lowered its key lending rate three times in 2025, yet President Trump has persistently criticized these cuts as insufficient.

Former Fed chairs, including Janet Yellen, Ben Bernanke, and Alan Greenspan, along with other former officials, have rallied behind Powell. In a joint statement, they warned that such prosecutorial attacks could have "highly negative consequences" for the economy, drawing parallels to monetary policies in countries with weaker institutions.

Political and Economic Implications

The investigation has sparked a political backlash, with several Republican lawmakers, including Senator Thom Tillis, threatening to block all Federal Reserve nominations until the legal matter is resolved. Tillis and others have voiced concerns that the probe undermines the Fed's independence, a sentiment echoed by Democratic Senator Elizabeth Warren, who warned that Trump's actions could damage America's global reputation.

Economists have also raised alarms, suggesting that political interference in the Fed could lead to inflation reminiscent of the 1970s. Atakan Bakiskan, a US economist, cautioned that if the Fed succumbs to political pressure, it could destabilize financial markets and deter foreign investment.

The Broader Context

This investigation is the latest in a series of confrontations between Trump and the Fed. The President has repeatedly urged Powell to lower interest rates to reduce government borrowing costs and stimulate the economy. Despite these pressures, Powell has maintained that the Fed's decisions are based on economic data rather than political preferences.

What this might mean

The ongoing investigation into Jerome Powell could have significant implications for the Federal Reserve's future operations and its perceived independence. If the DoJ proceeds with charges, it could set a precedent for increased political interference in monetary policy, potentially destabilizing financial markets. Economists warn that such actions could lead to inflationary pressures similar to those experienced in the 1970s, affecting both domestic and global economies.

Politically, the investigation may further polarize opinions on the Fed's role and independence, influencing future nominations and policy decisions. As Powell's term nears its end, the selection of his successor will likely become a focal point of contention, with implications for the Fed's policy direction and its ability to navigate economic challenges.